Page 346 - BTSGroup ONE REPORT 2021/22_EN

P. 346

344 l Introduction l Nature of Business l Organisation and Shareholding Structure l Business Review l Corporate Governance l Financial Statements l Other Information l

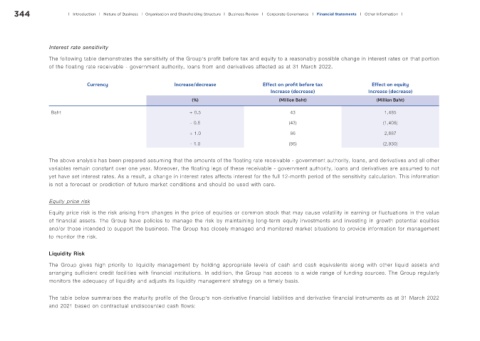

Interest rate sensitivity

The following table demonstrates the sensitivity of the Group’s profit before tax and equity to a reasonably possible change in interest rates on that portion

of the floating rate receivable - government authority, loans from and derivatives affected as at 31 March 2022.

Currency Increase/decrease Effect on prof t before tax Effect on equity

Increase (decrease) Increase (decrease)

(%) (Million Baht) (Million Baht)

Baht + 0.5 43 1,485

- 0.5 (43) (1,406)

+ 1.0 86 2,687

- 1.0 (86) (2,930)

The above analysis has been prepared assuming that the amounts of the floating rate receivable - government authority, loans, and derivatives and all other

variables remain constant over one year. Moreover, the floating legs of these receivable - government authority, loans and derivatives are assumed to not

yet have set interest rates. As a result, a change in interest rates affects interest for the full 12-month period of the sensitivity calculation. This information

is not a forecast or prediction of future market conditions and should be used with care.

Equity price risk

Equity price risk is the risk arising from changes in the price of equities or common stock that may cause volatility in earning or fluctuations in the value

of financial assets. The Group have policies to manage the risk by maintaining long-term equity investments and investing in growth potential equities

and/or those intended to support the business. The Group has closely managed and monitored market situations to provide information for management

to monitor the risk.

Liquidity Risk

The Group gives high priority to liquidity management by holding appropriate levels of cash and cash equivalents along with other liquid assets and

arranging sufficient credit facilities with financial institutions. In addition, the Group has access to a wide range of funding sources. The Group regularly

monitors the adequacy of liquidity and adjusts its liquidity management strategy on a timely basis.

The table below summarises the maturity profile of the Group’s non-derivative financial liabilities and derivative financial instruments as at 31 March 2022

and 2021 based on contractual undiscounted cash flows: