Page 351 - BTSGroup ONE REPORT 2021/22_EN

P. 351

BTS Group Holdings Public Company Limited 6.4 Notes to Consolidated Financial Statements 349

Annual Report 2021/22

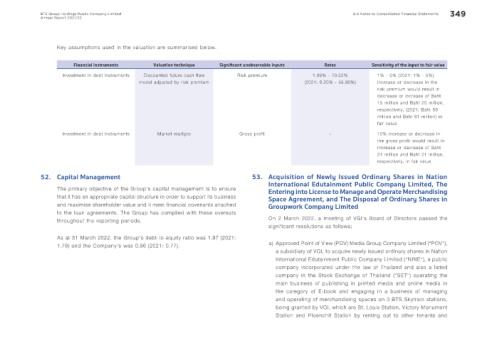

Key assumptions used in the valuation are summarised below.

Financial instruments Valuation technique Signif cant unobservable inputs Rates Sensitivity of the input to fair value

Investment in debt instruments Discounted future cash flow Risk premium 1.09% - 70.50% 1% - 5% (2021: 1% - 5%)

model adjusted by risk premium (2021: 8.20% - 55.90%) increase or decrease in the

risk premium would result in

decrease or increase of Baht

15 million and Baht 20 million,

respectively, (2021: Baht 59

million and Baht 61 million) in

fair value

Investment in debt instruments Market multiple Gross profit - 10% increase or decrease in

the gross profit would result in

increase or decrease of Baht

21 million and Baht 21 million,

respectively, in fair value

52. Capital Management 53. Acquisition of Newly Issued Ordinary Shares in Nation

The primary objective of the Group’s capital management is to ensure International Edutainment Public Company Limited, The

Entering into License to Manage and Operate Merchandising

that it has an appropriate capital structure in order to support its business Space Agreement, and The Disposal of Ordinary Shares in

and maximise shareholder value and it meet financial covenants attached Groupwork Company Limited

to the loan agreements. The Group has complied with these overeats

throughout the reporting periods. On 2 March 2022, a meeting of VGI’s Board of Directors passed the

significant resolutions as follows:

As at 31 March 2022, the Group’s debt-to-equity ratio was 1.97 (2021:

1.79) and the Company’s was 0.96 (2021: 0.77). a) Approved Point of View (POV) Media Group Company Limited (“POV”),

a subsidiary of VGI, to acquire newly issued ordinary shares in Nation

International Edutainment Public Company Limited (“NINE”), a public

company incorporated under the law of Thailand and also a listed

company in the Stock Exchange of Thailand (“SET”) operating the

main business of publishing in printed media and online media in

the category of E-book and engaging in a business of managing

and operating of merchandising spaces on 3 BTS Skytrain stations,

being granted by VGI, which are St. Louis Station, Victory Monument

Station and Ploenchit Station by renting out to other tenants and