Page 72 - BTSGroup ONE REPORT 2021/22_EN

P. 72

70 l Introduction l Nature of Business l Organisation and Shareholding Structure l Business Review l Corporate Governance l Financial Statements l Other Information l

3.4 DIVIDEND POLICY

Dividend Policy of the Company

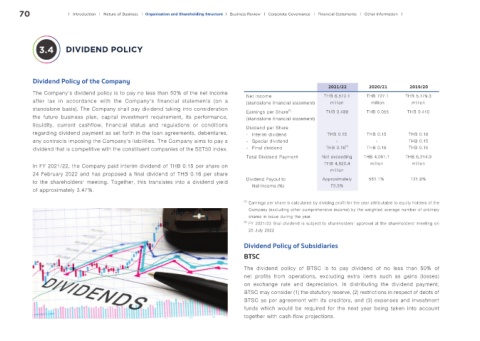

2021/22 2020/21 2019/20

The Company’s dividend policy is to pay no less than 50% of the net income Net Income THB 6,572.1 THB 727.1 THB 5,179.3

after tax in accordance with the Company’s financial statements (on a (standalone financial statement) million million million

standalone basis). The Company shall pay dividend taking into consideration Earnings per Share (1) THB 0.499 THB 0.055 THB 0.410

the future business plan, capital investment requirement, its performance, (standalone financial statement)

liquidity, current cashflow, financial status and regulations or conditions Dividend per Share

regarding dividend payment as set forth in the loan agreements, debentures, - Interim dividend THB 0.15 THB 0.15 THB 0.18

any contracts imposing the Company’s liabilities. The Company aims to pay a - Special dividend - - THB 0.15

dividend that is competitive with the constituent companies of the SET50 Index. - Final dividend THB 0.16 (2) THB 0.16 THB 0.15

Total Dividend Payment Not exceeding THB 4,081.1 THB 6,314.9

In FY 2021/22, the Company paid interim dividend of THB 0.15 per share on THB 4,820.4 million million

24 February 2022 and has proposed a final dividend of THB 0.16 per share million

to the shareholders’ meeting. Together, this translates into a dividend yield Dividend Payout to Approximately 561.1% 121.9%

Net Income (%)

73.3%

of approximately 3.47%.

(1) Earnings per share is calculated by dividing profit for the year attributable to equity holders of the

Company (excluding other comprehensive income) by the weighted average number of ordinary

shares in issue during the year.

(2) FY 2021/22 final dividend is subject to shareholders’ approval at the shareholders’ meeting on

25 July 2022

Dividend Policy of Subsidiaries

BTSC

The dividend policy of BTSC is to pay dividend of no less than 50% of

net profits from operations, excluding extra items such as gains (losses)

on exchange rate and depreciation. In distributing the dividend payment,

BTSC may consider (1) the statutory reserve, (2) restrictions in respect of debts of

BTSC as per agreement with its creditors, and (3) expenses and investment

funds which would be required for the next year being taken into account

together with cash-flow projections.