Page 259 - BTSGroup ONE REPORT 2021/22_EN

P. 259

BTS Group Holdings Public Company Limited 6.4 Notes to Consolidated Financial Statements 257

Annual Report 2021/22

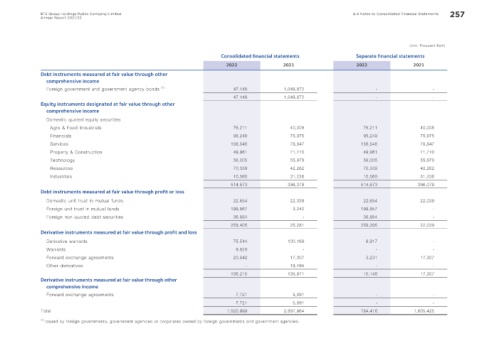

(Unit: Thousand Baht)

Consolidated f nancial statements Separate f nancial statements

2022 2021 2022 2021

Debt instruments measured at fair value through other

comprehensive income

Foreign government and government agency bonds (1) 47,148 1,048,872 - -

47,148 1,048,872 - -

Equity instruments designated at fair value through other

comprehensive income

Domestic quoted equity securities

Agro & Food Industrials 76,211 40,008 76,211 40,008

Financials 95,249 75,975 95,249 75,975

Services 156,548 78,847 156,548 78,847

Property & Construction 49,961 71,770 49,961 71,770

Technology 56,005 55,979 56,005 55,979

Resources 70,339 42,262 70,339 42,262

Industrials 10,560 31,238 10,560 31,238

514,873 396,079 514,873 396,079

Debt instruments measured at fair value through prof t or loss

Domestic unit trust in mutual funds 22,654 22,039 22,654 22,039

Foreign unit trust in mutual funds 199,867 3,242 199,857 -

Foreign non-quoted debt securities 36,884 - 36,884 -

259,405 25,281 259,395 22,039

Derivative instruments measured at fair value through prof t and loss

Derivative warrants 75,544 100,169 6,917 -

Warrants 9,829 - - -

Forward exchange agreements 20,842 17,307 3,231 17,307

Other derivatives - 18,495 - -

106,215 135,971 10,148 17,307

Derivative instruments measured at fair value through other

comprehensive income

Forward exchange agreements 7,721 5,891 - -

7,721 5,891 - -

Total 1,020,999 2,887,964 784,416 1,605,425

(1) Issued by foreign governments, government agencies or corporates owned by foreign governments and government agencies.