Page 129 - BTSGroup ONE REPORT 2021/22_EN

P. 129

BTS Group Holdings Public Company Limited 4.4 Management Discussion and Analysis 127

Annual Report 2021/22

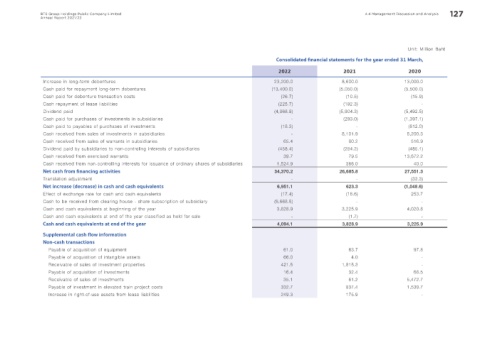

Unit: Million Baht

Consolidated financial statements for the year ended 31 March,

2022 2021 2020

Increase in long-term debentures 23,200.0 8,600.0 13,000.0

Cash paid for repayment long-term debentures (13,400.0) (5,050.0) (5,500.0)

Cash paid for debenture transaction costs (26.7) (10.5) (15.9)

Cash repayment of lease liabilities (225.7) (192.3) -

Dividend paid (4,068.9) (5,904.3) (5,492.5)

Cash paid for purchases of investments in subsidiaries - (293.0) (1,397.1)

Cash paid to payables of purchases of investments (18.3) - (812.0)

Cash received from sales of investments in subsidiaries - 8,101.9 5,200.3

Cash received from sales of warrants in subsidiaries 65.4 80.2 516.9

Dividend paid by subsidiaries to non-controling interests of subsidiaries (458.4) (284.2) (485.1)

Cash received from exercised warrants 39.7 79.5 13,672.2

Cash received from non-controlling interests for issuance of ordinary shares of subsidiaries 1,524.9 366.0 40.0

Net cash from financing activities 34,370.2 26,685.8 27,551.3

Translation adjustment - - (33.3)

Net increase (decrease) in cash and cash equivalents 6,951.1 623.3 (1,048.6)

Effect of exchange rate for cash and cash equivalents (17.4) (18.6) 253.7

Cash to be received from clearing house - share subscription of subsidiary (6,668.5) - -

Cash and cash equivalents at beginning of the year 3,828.9 3,225.9 4,020.8

Cash and cash equivalents at end of the year classified as held for sale - (1.7) -

Cash and cash equivalents at end of the year 4,094.1 3,828.9 3,225.9

Supplemental cash flow information

Non-cash transactions

Payable of acquisition of equipment 61.0 63.7 97.8

Payable of acquisition of intangible assets 66.0 4.0 -

Receivable of sales of investment properties 421.5 1,815.3 -

Payable of acquisition of investments 16.4 32.4 68.5

Receivable of sales of investments 35.1 61.2 5,472.7

Payable of investment in elevated train project costs 332.7 837.4 1,539.7

Increase in right-of-use assets from lease liabilities 249.3 175.9 -