Page 127 - BTSGroup ONE REPORT 2021/22_EN

P. 127

BTS Group Holdings Public Company Limited 4.4 Management Discussion and Analysis 125

Annual Report 2021/22

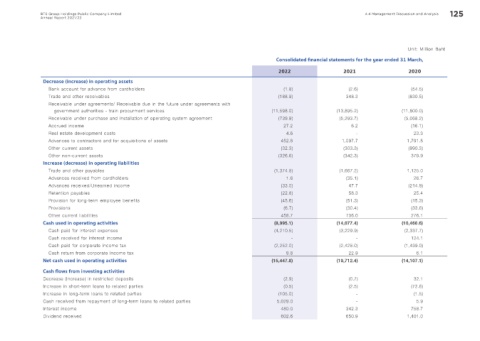

Unit: Million Baht

Consolidated financial statements for the year ended 31 March,

2022 2021 2020

Decrease (increase) in operating assets

Bank account for advance from cardholders (1.8) (2.6) (54.5)

Trade and other receivables (188.9) 348.3 (830.5)

Receivable under agreements/ Receivable due in the future under agreements with

government authorities - train procurment services (11,598.0) (13,895.2) (11,800.0)

Receivable under purchase and installation of operating system agreement (739.9) (5,293.7) (5,068.2)

Accrued income 27.2 6.2 (16.1)

Real estate development costs 4.6 - 23.3

Advances to contractors and for acquisitions of assets 452.8 1,097.7 1,791.5

Other current assets (32.3) (303.3) (990.3)

Other non-current assets (326.6) (342.3) 379.9

Increase (decrease) in operating liabilities

Trade and other payables (1,374.8) (1,667.2) 1,125.0

Advances received from cardholders 1.6 (35.1) 26.7

Advances received/Unearned income (33.0) 47.7 (214.9)

Retention payables (22.8) 58.3 25.4

Provision for long-term employee benefits (45.6) (51.3) (15.3)

Provisions (6.7) (30.4) (33.8)

Other current liabilities 458.7 736.0 276.1

Cash used in operating activities (8,995.1) (14,077.4) (10,460.6)

Cash paid for interest expenses (4,210.5) (3,229.9) (2,337.7)

Cash received for interest income - - 124.1

Cash paid for corporate income tax (2,252.0) (2,428.0) (1,439.0)

Cash return from corporate income tax 9.8 22.9 6.1

Net cash used in operating activities (15,447.8) (19,712.4) (14,107.1)

Cash flows from investing activities

Decrease (increase) in restricted deposits (2.9) (0.7) 32.1

Increase in short-term loans to related parties (0.5) (2.5) (72.8)

Increase in long-term loans to related parties (105.0) - (1.5)

Cash received from repayment of long-term loans to related parties 5,029.0 - 5.9

Interest income 480.0 342.3 758.7

Dividend received 602.6 650.9 1,401.0