Page 18 - BTSGroup ONE REPORT 2021/22_EN

P. 18

16 l Introduction l Nature of Business l Organisation and Shareholding Structure l Business Review l Corporate Governance l Financial Statements l Other Information l

1.5 IMPORTANT EVENTS DURING

THE PAST THREE YEARS

BTS GROUP Debentures

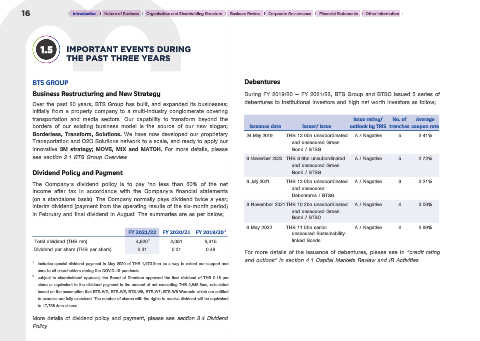

Business Restructuring and New Strategy During FY 2019/20 – FY 2021/22, BTS Group and BTSC issued 5 series of

Over the past 20 years, BTS Group has built, and expanded its businesses; debentures to institutional investors and high net worth investors as follow;

initially from a property company to a multi-industry conglomerate covering

transportation and media sectors. Our capability to transform beyond the Issue rating/ No. of Average

borders of our existing business model is the source of our new slogan; Issuance date Issuer/ Issue outlook by TRIS tranches coupon rate

Borderless, Transform, Solutions. We have now developed our proprietary 24 May 2019 THB 13.0bn unsubordinated A / Negative 5 3.41%

Transportation and O2O Solutions network to a scale, and ready to apply our and unsecured Green

innovative 3M strategy; MOVE, MIX and MATCH. For more details, please Bond / BTSG

see section 2.1 BTS Group Overview. 6 November 2020 THB 8.6bn unsubordinated A / Negative 5 2.72%

and unsecured Green

Dividend Policy and Payment Bond / BTSG

The Company’s dividend policy is to pay ‘no less than 50% of the net 6 July 2021 THB 13.0bn unsubordinated A / Negative 3 3.21%

and unsecured

income after tax in accordance with the Company’s financial statements Debentures / BTSG

(on a standalone basis). The Company normally pays dividend twice a year;

interim dividend (payment from the operating results of the six-month period) 8 November 2021THB 10.2bn unsubordinated A / Negative 4 3.06%

and unsecured Green

in February and final dividend in August. The summaries are as per below; Bond / BTSC

6 May 2022 THB 11.0bn senior A / Negative 4 3.99%

FY 2021/22 FY 2020/21 FY 2019/20 1 unsecured Sustainability-

Total dividend (THB mn) 4,820 2 4,081 6,315 linked Bonds

Dividend per share (THB per share) 0.31 0.31 0.48 For more details of the issuance of debentures, please see in “credit rating

and outlook” in section 4.1 Capital Markets Review and IR Activities.

1 includes special dividend payment in May 2020 of THB 1,973.2mn as a way to extent our support and

care to all shareholders during the COVID-19 pandemic

2 subject to shareholders’ approval, the Board of Directors approved the final dividend of THB 0.16 per

share or equivalent to the dividend payment in the amount of not exceeding THB 2,845.8mn, calculated

based on the assumption that BTS-WD, BTS-WE, BTS-W6, BTS-W7, BTS-W8 Warrants which are entitled

to exercise are fully exercised. The number of shares with the rights to receive dividend will be equivalent

to 17,786.4mn shares.

More details of dividend policy and payment, please see section 3.4 Dividend

Policy.