Page 24 - BTSGroup ONE REPORT 2021/22_EN

P. 24

22 l Introduction l Nature of Business l Organisation and Shareholding Structure l Business Review l Corporate Governance l Financial Statements l Other Information l

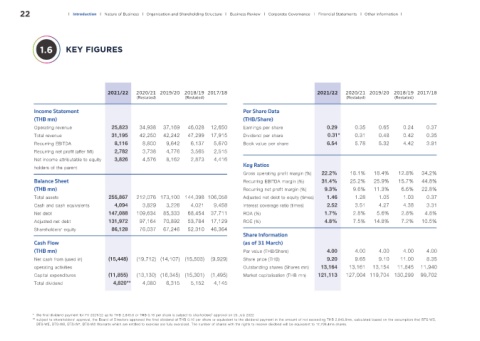

1.6 KEY FIGURES

2021/22 2020/21 2019/20 2018/19 2017/18 2021/22 2020/21 2019/20 2018/19 2017/18

(Restated) (Restated) (Restated) (Restated)

Income Statement Per Share Data

(THB mn) (THB/Share)

Operating revenue 25,823 34,938 37,169 46,028 12,650 Earnings per share 0.29 0.35 0.65 0.24 0.37

Total revenue 31,195 42,250 42,242 47,299 17,915 Dividend per share 0.31* 0.31 0.48 0.42 0.35

Recurring EBITDA 8,116 8,800 9,642 6,137 5,670 Book value per share 6.54 5.78 5.32 4.42 3.91

Recurring net profit (after MI) 2,782 3,738 4,776 3,565 2,515

Net income attributable to equity 3,826 4,576 8,162 2,873 4,416

holders of the parent Key Ratios

Gross operating profit margin (%) 22.2% 18.1% 18.4% 12.8% 34.2%

Balance Sheet Recurring EBITDA margin (%) 31.4% 25.2% 25.9% 15.7% 44.8%

(THB mn) Recurring net profit margin (%) 9.3% 9.6% 11.3% 6.6% 22.8%

Total assets 255,867 212,076 173,100 144,398 106,058 Adjusted net debt to equity (times) 1.46 1.28 1.05 1.03 0.37

Cash and cash equivalents 4,094 3,829 3,226 4,021 9,458 Interest coverage ratio (times) 2.52 3.51 4.27 4.38 3.31

Net debt 147,088 109,634 85,333 68,454 37,711 ROA (%) 1.7% 2.8% 5.6% 2.8% 4.8%

Adjusted net debt 131,972 97,164 70,892 53,784 17,129 ROE (%) 4.8% 7.5% 14.8% 7.2% 10.5%

Shareholders’ equity 86,128 76,037 67,246 52,310 46,364

Share Information

Cash Flow (as of 31 March)

(THB mn) Par value (THB/Share) 4.00 4.00 4.00 4.00 4.00

Net cash from (used in) (15,448) (19,712) (14,107) (15,503) (9,929) Share price (THB) 9.20 9.65 9.10 11.00 8.35

operating activities Outstanding shares (Shares mn) 13,164 13,161 13,154 11,845 11,940

Capital expenditures (11,855) (13,130) (16,345) (15,301) (1,495) Market capitalisation (THB mn) 121,113 127,004 119,704 130,299 99,702

Total dividend 4,820** 4,080 6,315 5,152 4,145

* the final dividend payment for FY 2021/22 up to THB 2,845.8 or THB 0.16 per share is subject to sharholders' approval on 25 July 2022

** subject to shareholders’ approval, the Board of Directors approved the final dividend of THB 0.16 per share or equivalent to the dividend payment in the amount of not exceeding THB 2,845.8mn, calculated based on the assumption that BTS-WD,

BTS-WE, BTS-W6, BTS-W7, BTS-W8 Warrants which are entitled to exercise are fully exercised. The number of shares with the rights to receive dividend will be equivalent to 17,786.4mn shares.