Page 278 - BTSGroup ONE REPORT 2021/22_EN

P. 278

276 l Introduction l Nature of Business l Organisation and Shareholding Structure l Business Review l Corporate Governance l Financial Statements l Other Information l

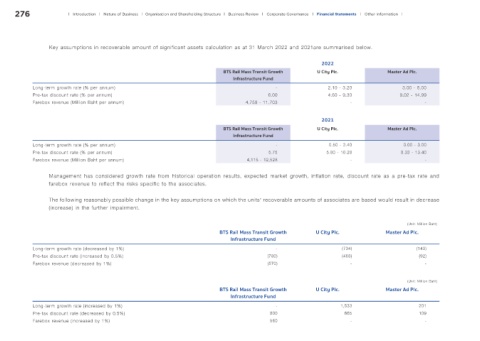

Key assumptions in recoverable amount of significant assets calculation as at 31 March 2022 and 2021are summarised below.

2022

BTS Rail Mass Transit Growth U City Plc. Master Ad Plc.

Infrastructure Fund

Long-term growth rate (% per annum) - 2.10 - 3.20 3.00 - 5.00

Pre-tax discount rate (% per annum) 6.00 4.60 - 9.30 9.02 - 14.99

Farebox revenue (Million Baht per annum) 4,759 - 11,703 - -

2021

BTS Rail Mass Transit Growth U City Plc. Master Ad Plc.

Infrastructure Fund

Long-term growth rate (% per annum) - 0.50 - 3.40 0.00 - 3.00

Pre-tax discount rate (% per annum) 5.75 5.80 - 10.28 8.33 - 13.40

Farebox revenue (Million Baht per annum) 4,115 - 12,528 - -

Management has considered growth rate from historical operation results, expected market growth, inflation rate, discount rate as a pre-tax rate and

farebox revenue to reflect the risks specific to the associates.

The following reasonably possible change in the key assumptions on which the units’ recoverable amounts of associates are based would result in decrease

(increase) in the further impairment.

(Unit: Million Baht)

BTS Rail Mass Transit Growth U City Plc. Master Ad Plc.

Infrastructure Fund

Long-term growth rate (decreased by 1%) - (734) (143)

Pre-tax discount rate (increased by 0.5%) (780) (468) (92)

Farebox revenue (decreased by 1%) (570) - -

(Unit: Million Baht)

BTS Rail Mass Transit Growth U City Plc. Master Ad Plc.

Infrastructure Fund

Long-term growth rate (increased by 1%) - 1,533 201

Pre-tax discount rate (decreased by 0.5%) 800 665 109

Farebox revenue (increased by 1%) 560 - -