Page 280 - BTSGroup ONE REPORT 2021/22_EN

P. 280

278 l Introduction l Nature of Business l Organisation and Shareholding Structure l Business Review l Corporate Governance l Financial Statements l Other Information l

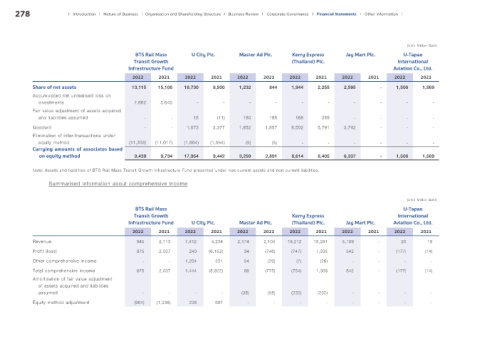

(Unit: Million Baht)

BTS Rail Mass U City Plc. Master Ad Plc. Kerry Express Jay Mart Plc. U-Tapao

Transit Growth (Thailand) Plc. International

Infrastructure Fund Aviation Co., Ltd.

2022 2021 2022 2021 2022 2021 2022 2021 2022 2021 2022 2021

Share of net assets 13,115 15,106 18,730 8,930 1,232 844 1,944 2,255 2,595 - 1,508 1,569

Accumulated net unrealised loss on

investments 7,662 5,645 - - - - - - - - - -

Fair value adjustment of assets acquired

and liabilities assumed - - 15 (11) 180 195 168 359 - - - -

Goodwill - - 1,073 2,377 1,852 1,857 6,502 5,791 3,742 - - -

Elimination of inter-transactions under

equity method (11,338) (11,017) (1,864) (1,854) (5) (5) - - - - - -

Carrying amounts of associates based

on equity method 9,439 9,734 17,954 9,442 3,259 2,891 8,614 8,405 6,337 - 1,508 1,569

Note: Assets and liabilities of BTS Rail Mass Transit Growth Infrastructure Fund presented under non-current assets and non-current liabilities.

Summarised information about comprehensive income

(Unit: Million Baht)

BTS Rail Mass U-Tapao

Transit Growth Kerry Express International

Infrastructure Fund U City Plc. Master Ad Plc. (Thailand) Plc. Jay Mart Plc. Aviation Co., Ltd.

2022 2021 2022 2021 2022 2021 2022 2021 2022 2021 2022 2021

Revenue 945 2,113 7,412 4,234 2,174 2,104 19,212 18,291 5,109 - 20 19

Profit (loss) 875 2,037 240 (6,153) 34 (746) (747) 1,335 542 - (177) (14)

Other comprehensive income - - 1,204 231 54 (29) (7) (26) - - - -

Total comprehensive income 875 2,037 1,444 (5,922) 88 (775) (754) 1,309 542 - (177) (14)

Amortisation of fair value adjustment

of assets acquired and liabilities

assumed - - - - (36) (58) (232) (232) - - - -

Equity method adjustment (964) (1,336) 238 687 - - - - - - - -