Page 285 - BTSGroup ONE REPORT 2021/22_EN

P. 285

BTS Group Holdings Public Company Limited 6.4 Notes to Consolidated Financial Statements 283

Annual Report 2021/22

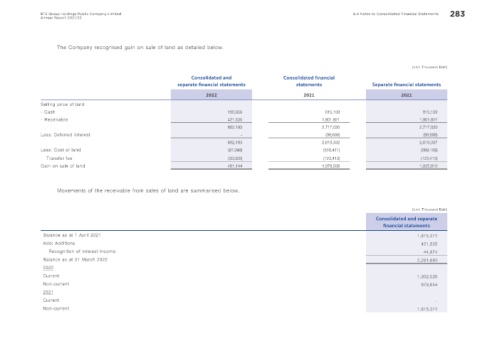

The Company recognised gain on sale of land as detailed below.

(Unit: Thousand Baht)

Consolidated and Consolidated f nancial

separate f nancial statements statements Separate f nancial statements

2022 2021 2021

Selling price of land

- Cash 180,658 815,109 815,109

- Receivable 421,535 1,901,921 1,901,921

602,193 2,717,030 2,717,030

Less: Deferred interest - (98,698) (98,698)

602,193 2,618,332 2,618,337

Less: Cost of land (91,049) (516,411) (569,109)

Transfer fee (30,000) (123,413) (123,413)

Gain on sale of land 481,144 1,978,508 1,925,810

Movements of the receivable from sales of land are summarised below.

(Unit: Thousand Baht)

Consolidated and separate

f nancial statements

Balance as at 1 April 2021 1,815,271

Add: Additions 421,535

Recognition of interest income 44,874

Balance as at 31 March 2022 2,281,680

2022

Current 1,302,026

Non-current 979,654

2021

Current -

Non-current 1,815,271