Page 289 - BTSGroup ONE REPORT 2021/22_EN

P. 289

BTS Group Holdings Public Company Limited 6.4 Notes to Consolidated Financial Statements 287

Annual Report 2021/22

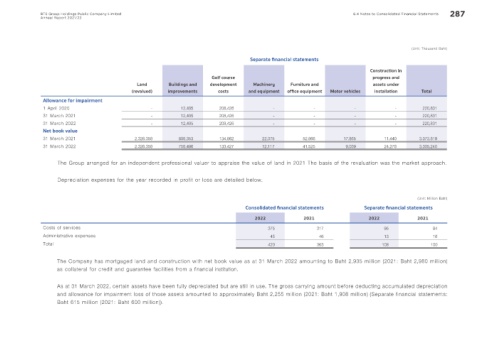

(Unit: Thousand Baht)

Separate f nancial statements

Construction in

Golf course progress and

Land Buildings and development Machinery Furniture and assets under

(revalued) improvements costs and equipment off ce equipment Motor vehicles installation Total

Allowance for impairment

1 April 2020 - 12,405 208,426 - - - - 220,831

31 March 2021 - 12,405 208,426 - - - - 220,831

31 March 2022 - 12,405 208,426 - - - - 220,831

Net book value

31 March 2021 2,326,358 808,353 134,862 22,075 52,866 17,865 11,440 3,373,819

31 March 2022 2,326,358 758,496 133,427 12,117 41,525 9,039 24,278 3,305,240

The Group arranged for an independent professional valuer to appraise the value of land in 2021 The basis of the revaluation was the market approach.

Depreciation expenses for the year recorded in profit or loss are detailed below.

(Unit: Million Baht)

Consolidated f nancial statements Separate f nancial statements

2022 2021 2022 2021

Costs of services 375 317 95 84

Administrative expenses 45 46 13 16

Total 420 363 108 100

The Company has mortgaged land and construction with net book value as at 31 March 2022 amounting to Baht 2,935 million (2021: Baht 2,980 million)

as collateral for credit and guarantee facilities from a financial institution.

As at 31 March 2022, certain assets have been fully depreciated but are still in use. The gross carrying amount before deducting accumulated depreciation

and allowance for impairment loss of those assets amounted to approximately Baht 2,255 million (2021: Baht 1,908 million) (Separate financial statements:

Baht 615 million (2021: Baht 600 million)).