Page 293 - BTSGroup ONE REPORT 2021/22_EN

P. 293

BTS Group Holdings Public Company Limited 6.4 Notes to Consolidated Financial Statements 291

Annual Report 2021/22

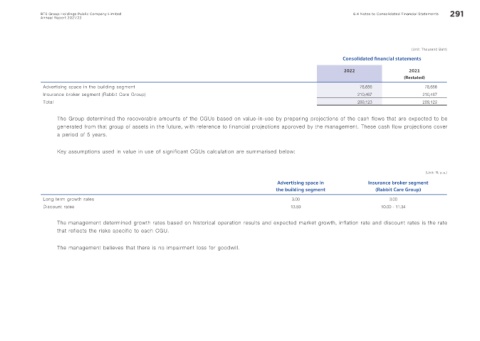

(Unit: Thousand Baht)

Consolidated f nancial statements

2022 2021

(Restated)

Advertising space in the building segment 78,656 78,656

Insurance broker segment (Rabbit Care Group) 210,467 210,467

Total 289,123 289,123

The Group determined the recoverable amounts of the CGUs based on value-in-use by preparing projections of the cash flows that are expected to be

generated from that group of assets in the future, with reference to financial projections approved by the management. These cash flow projections cover

a period of 5 years.

Key assumptions used in value in use of significant CGUs calculation are summarised below:

(Unit: % p.a.)

Advertising space in Insurance broker segment

the building segment (Rabbit Care Group)

Long term growth rates 3.00 3.00

Discount rates 13.59 10.00 - 11.34

The management determined growth rates based on historical operation results and expected market growth, inflation rate and discount rates is the rate

that reflects the risks specific to each CGU.

The management believes that there is no impairment loss for goodwill.