Page 295 - BTSGroup ONE REPORT 2021/22_EN

P. 295

BTS Group Holdings Public Company Limited 6.4 Notes to Consolidated Financial Statements 293

Annual Report 2021/22

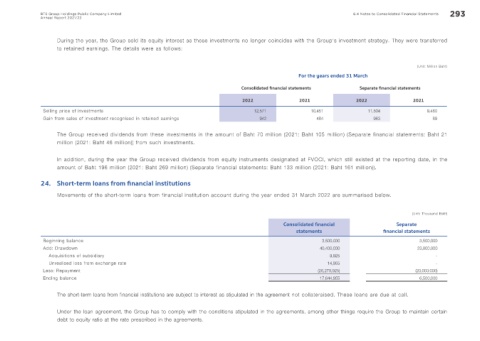

During the year, the Group sold its equity interest as these investments no longer coincides with the Group’s investment strategy. They were transferred

to retained earnings. The details were as follows:

(Unit: Million Baht)

For the years ended 31 March

Consolidated f nancial statements Separate f nancial statements

2022 2021 2022 2021

Selling price of investments 12,571 10,451 11,504 9,460

Gain from sales of investment recognised in retained earnings 942 484 963 89

The Group received dividends from these investments in the amount of Baht 70 million (2021: Baht 105 million) (Separate financial statements: Baht 21

million (2021: Baht 46 million)) from such investments.

In addition, during the year the Group received dividends from equity instruments designated at FVOCI, which still existed at the reporting date, in the

amount of Baht 196 million (2021: Baht 269 million) (Separate financial statements: Baht 133 million (2021: Baht 161 million)).

24. Short-term loans from f nancial institutions

Movements of the short-term loans from financial institution account during the year ended 31 March 2022 are summarised below.

(Unit: Thousand Baht)

Consolidated f nancial Separate

statements f nancial statements

Beginning balance 3,500,000 3,500,000

Add: Drawdown 40,400,000 23,000,000

Acquisitions of subsidiary 9,925 -

Unrealised loss from exchange rate 14,955 -

Less: Repayment (26,279,925) (20,000,000)

Ending balance 17,644,955 6,500,000

The short-term loans from financial institutions are subject to interest as stipulated in the agreement not collateraised. These loans are due at call.

Under the loan agreement, the Group has to comply with the conditions stipulated in the agreements, among other things require the Group to maintain certain

debt to equity ratio at the rate prescribed in the agreements.