Page 298 - BTSGroup ONE REPORT 2021/22_EN

P. 298

296 l Introduction l Nature of Business l Organisation and Shareholding Structure l Business Review l Corporate Governance l Financial Statements l Other Information l

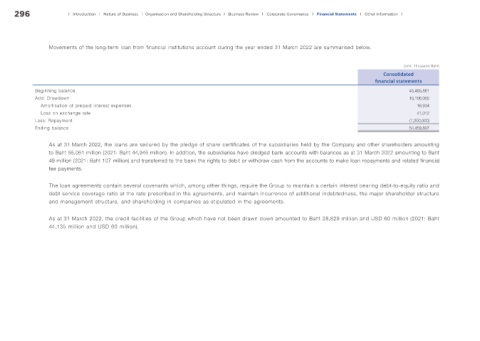

Movements of the long-term loan from financial institutions account during the year ended 31 March 2022 are summarised below.

(Unit: Thousand Baht)

Consolidated

f nancial statements

Beginning balance 45,495,861

Add: Drawdown 10,106,000

Amortisation of prepaid interest expenses 16,934

Loss on exchange rate 41,012

Less: Repayment (1,200,000)

Ending balance 54,459,807

As at 31 March 2022, the loans are secured by the pledge of share certificates of the subsidiaries held by the Company and other shareholders amounting

to Baht 55,051 million (2021: Baht 44,945 million). In addition, the subsidiaries have pledged bank accounts with balances as at 31 March 2022 amounting to Baht

49 million (2021: Baht 107 million) and transferred to the bank the rights to debit or withdraw cash from the accounts to make loan repayments and related financial

fee payments.

The loan agreements contain several covenants which, among other things, require the Group to maintain a certain interest bearing debt-to-equity ratio and

debt service coverage ratio at the rate prescribed in the agreements, and maintain incurrence of additional indebtedness, the major shareholder structure

and management structure, and shareholding in companies as stipulated in the agreements.

As at 31 March 2022, the credit facilities of the Group which have not been drawn down amounted to Baht 28,829 million and USD 60 million (2021: Baht

44,135 million and USD 60 million).