Page 301 - BTSGroup ONE REPORT 2021/22_EN

P. 301

BTS Group Holdings Public Company Limited 6.4 Notes to Consolidated Financial Statements 299

Annual Report 2021/22

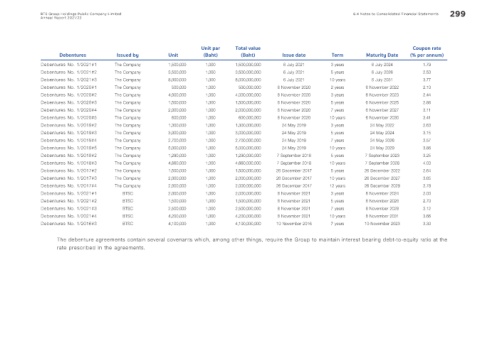

Unit par Total value Coupon rate

Debentures Issued by Unit (Baht) (Baht) Issue date Term Maturity Date (% per annum)

Debentures No. 1/2021#1 The Company 1,500,000 1,000 1,500,000,000 6 July 2021 3 years 6 July 2024 1.79

Debentures No. 1/2021#2 The Company 3,500,000 1,000 3,500,000,000 6 July 2021 5 years 6 July 2026 2.53

Debentures No. 1/2021#3 The Company 8,000,000 1,000 8,000,000,000 6 July 2021 10 years 6 July 2031 3.77

Debentures No. 1/2020#1 The Company 500,000 1,000 500,000,000 6 November 2020 2 years 6 November 2022 2.10

Debentures No. 1/2020#2 The Company 4,000,000 1,000 4,000,000,000 6 November 2020 3 years 6 November 2023 2.44

Debentures No. 1/2020#3 The Company 1,500,000 1,000 1,500,000,000 6 November 2020 5 years 6 November 2025 2.86

Debentures No. 1/2020#4 The Company 2,000,000 1,000 2,000,000,000 6 November 2020 7 years 6 November 2027 3.11

Debentures No. 1/2020#5 The Company 600,000 1,000 600,000,000 6 November 2020 10 years 6 November 2030 3.41

Debentures No. 1/2019#2 The Company 1,300,000 1,000 1,300,000,000 24 May 2019 3 years 24 May 2022 2.63

Debentures No. 1/2019#3 The Company 3,000,000 1,000 3,000,000,000 24 May 2019 5 years 24 May 2024 3.15

Debentures No. 1/2019#4 The Company 2,700,000 1,000 2,700,000,000 24 May 2019 7 years 24 May 2026 3.57

Debentures No. 1/2019#5 The Company 5,000,000 1,000 5,000,000,000 24 May 2019 10 years 24 May 2029 3.86

Debentures No. 1/2018#2 The Company 1,290,000 1,000 1,290,000,000 7 September 2018 5 years 7 September 2023 3.25

Debentures No. 1/2018#3 The Company 4,660,000 1,000 4,660,000,000 7 September 2018 10 years 7 September 2028 4.03

Debentures No. 1/2017#2 The Company 1,500,000 1,000 1,500,000,000 26 December 2017 5 years 26 December 2022 2.64

Debentures No. 1/2017#3 The Company 2,000,000 1,000 2,000,000,000 26 December 2017 10 years 26 December 2027 3.65

Debentures No. 1/2017#4 The Company 2,000,000 1,000 2,000,000,000 26 December 2017 12 years 26 December 2029 3.78

Debentures No. 1/2021#1 BTSC 2,000,000 1,000 2,000,000,000 8 November 2021 3 years 8 November 2024 2.00

Debentures No. 1/2021#2 BTSC 1,500,000 1,000 1,500,000,000 8 November 2021 5 years 8 November 2026 2.70

Debentures No. 1/2021#3 BTSC 2,500,000 1,000 2,500,000,000 8 November 2021 7 years 8 November 2028 3.12

Debentures No. 1/2021#4 BTSC 4,200,000 1,000 4,200,000,000 8 November 2021 10 years 8 November 2031 3.66

Debentures No. 1/2016#3 BTSC 4,100,000 1,000 4,100,000,000 10 November 2016 7 years 10 November 2023 3.30

The debenture agreements contain several covenants which, among other things, require the Group to maintain interest bearing debt-to-equity ratio at the

rate prescribed in the agreements.