Page 284 - BTSGroup ONE REPORT 2021/22_EN

P. 284

282 l Introduction l Nature of Business l Organisation and Shareholding Structure l Business Review l Corporate Governance l Financial Statements l Other Information l

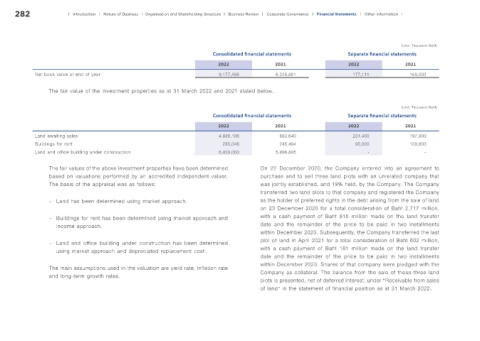

(Unit: Thousand Baht)

Consolidated f nancial statements Separate f nancial statements

2022 2021 2022 2021

Net book value at end of year 9,177,466 6,228,881 177,111 169,093

The fair value of the investment properties as at 31 March 2022 and 2021 stated below.

(Unit: Thousand Baht)

Consolidated f nancial statements Separate f nancial statements

2022 2021 2022 2021

Land awaiting sales 4,886,106 683,640 231,400 197,800

Buildings for rent 255,046 245,494 95,000 109,800

Land and office building under construction 6,420,000 5,898,895 - -

The fair values of the above investment properties have been determined On 22 December 2020, the Company entered into an agreement to

based on valuations performed by an accredited independent valuer. purchase and to sell three land plots with an unrelated company that

The basis of the appraisal was as follows: was jointly established, and 19% held, by the Company. The Company

transferred two land plots to that company and registered the Company

- Land has been determined using market approach. as the holder of preferred rights in the debt arising from the sale of land

on 23 December 2020 for a total consideration of Baht 2,717 million,

- Buildings for rent has been determined using market approach and with a cash payment of Baht 815 million made on the land transfer

income approach. date and the remainder of the price to be paid in two installments

within December 2023. Subsequently, the Company transferred the last

- Land and office building under construction has been determined plot of land in April 2021 for a total consideration of Baht 602 million,

using market approach and depreciated replacement cost. with a cash payment of Baht 181 million made on the land transfer

date and the remainder of the price to be paid in two installments

The main assumptions used in the valuation are yield rate, inflation rate within December 2023. Shares of that company were pledged with the

and long-term growth rates. Company as collateral. The balance from the sale of these three land

plots is presented, net of deferred interest, under “Receivable from sales

of land” in the statement of financial position as at 31 March 2022.