Page 113 - BTSGroup ONE REPORT 2021/22_EN

P. 113

BTS Group Holdings Public Company Limited 4.4 Management Discussion and Analysis 111

Annual Report 2021/22

MATCH Business Financial Position

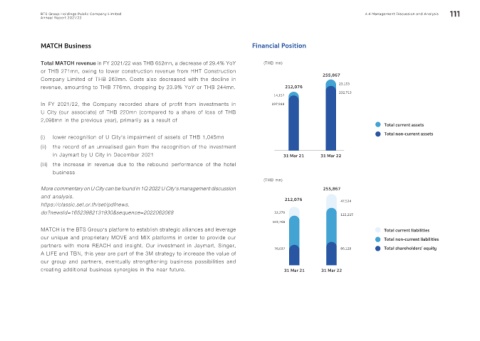

Total MATCH revenue in FY 2021/22 was THB 652mn, a decrease of 29.4% YoY (THB mn)

or THB 271mn, owing to lower construction revenue from HHT Construction

Company Limited of THB 263mn. Costs also decreased with the decline in 255,867

revenue, amounting to THB 776mn, dropping by 23.9% YoY or THB 244mn. 212,076 23,153

232,713

14,157

In FY 2021/22, the Company recorded share of profit from investments in 197,918

U City (our associate) of THB 220mn (compared to a share of loss of THB

2,098mn in the previous year), primarily as a result of

Total current assets

(i) lower recognition of U City’s impairment of assets of THB 1,045mn Total non-current assets

(ii) the record of an unrealised gain from the recognition of the investment

in Jaymart by U City in December 2021 31 Mar 21 31 Mar 22

(iii) the increase in revenue due to the rebound performance of the hotel

business

(THB mn)

More commentary on U City can be found in 1Q 2022 U City’s management discussion 255,867

and analysis. 212,076

https://classic.set.or.th/set/pdfnews. 47,524

do?newsId=16523982131930&sequence=2022062068 32,270 122,215

103,768

MATCH is the BTS Group’s platform to establish strategic alliances and leverage Total current liabilities

our unique and proprietary MOVE and MIX platforms in order to provide our Total non-current liabilities

partners with more REACH and insight. Our investment in Jaymart, Singer, 76,037 86,128 Total shareholders’ equity

A LIFE and TBN, this year are part of the 3M strategy to increase the value of

our group and partners, eventually strengthening business possibilities and

creating additional business synergies in the near future. 31 Mar 21 31 Mar 22