Page 115 - BTSGroup ONE REPORT 2021/22_EN

P. 115

BTS Group Holdings Public Company Limited 4.4 Management Discussion and Analysis 113

Annual Report 2021/22

14,077mn in FY 2020/21). This was derived from profit before tax of THB of THB 8,906mn mainly for the drawdown of syndicated loans related to the

5,095mn, being partially offset by (i) non-cash reconciling items of THB 665mn Pink and Yellow Lines and (iv) cash received from non-controlling interests for

and (ii) changes in net working capital of THB 13,425mn, chiefly from (a) an issuance of ordinary shares of subsidiaries of THB 1,525mn from payments

increase in a receivable under agreements with government authority of THB of additional share capital in NBM and EBM, partly offset with (v) dividend

7,618mn mainly from the provision of the O&M services for the Green Line payment of THB 4,069mn in August 2021 and February 2022.

extensions and (ii) the investment for construction of the Pink and Yellow

Lines of THB 5.3bn. After deducting cash paid for interest expense of THB

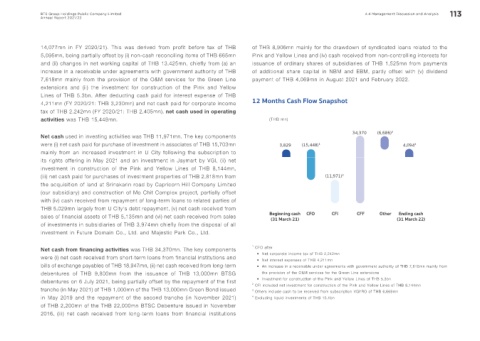

4,211mn (FY 2020/21: THB 3,230mn) and net cash paid for corporate income 12 Months Cash Flow Snapshot

tax of THB 2,242mn (FY 2020/21: THB 2,405mn), net cash used in operating

activities was THB 15,448mn. (THB mn)

Net cash used in investing activities was THB 11,971mn. The key components 34,370 (6,686) 3

were (i) net cash paid for purchase of investment in associates of THB 15,703mn 3,829 (15,448) 1 4,094 4

mainly from an increased investment in U City following the subscription to

its rights offering in May 2021 and an investment in Jaymart by VGI, (ii) net

investment in construction of the Pink and Yellow Lines of THB 8,144mn,

(iii) net cash paid for purchases of investment properties of THB 2,818mn from (11,971) 2

the acquisition of land at Srinakarin road by Capricorn Hill Company Limited

(our subsidiary) and construction of Mo Chit Complex project, partially offset

with (iv) cash received from repayment of long-term loans to related parties of

THB 5,029mn largely from U City’s debt repayment, (v) net cash received from

Ending cash

sales of financial assets of THB 5,135mn and (vi) net cash received from sales Beginning cash CFO CFI CFF Other (31 March 22)

(31 March 21)

of investments in subsidiaries of THB 3,974mn chiefly from the disposal of all

investment in Future Domain Co., Ltd. and Majestic Park Co., Ltd.

Net cash from financing activities was THB 34,370mn. The key components 1 CFO after

were (i) net cash received from short-term loans from financial institutions and • Net corporate income tax of THB 2,242mn

• Net interest expenses of THB 4,211mn

bills of exchange payables of THB 18,947mn, (ii) net cash received from long-term • An increase in a receivable under agreements with government authority of THB 7,618mn mainly from

debentures of THB 9,800mn from the issuance of THB 13,000mn BTSG the provision of the O&M services for the Green Line extensions

debentures on 6 July 2021, being partially offset by the repayment of the first • Investment for construction of the Pink and Yellow Lines of THB 5.3bn

2

CFI included net investment for construction of the Pink and Yellow Lines of THB 8,144mn

tranche (in May 2021) of THB 1,000mn of the THB 13,000mn Green Bond issued 3 Others include cash to be received from subscription VGI’RO of THB 6,669mn

in May 2019 and the repayment of the second tranche (in November 2021) 4 Excluding liquid investments of THB 15.1bn

of THB 2,200mn of the THB 22,000mn BTSC Debenture issued in November

2016, (iii) net cash received from long-term loans from financial institutions