Page 116 - BTSGroup ONE REPORT 2021/22_EN

P. 116

114 l Introduction l Nature of Business l Organisation and Shareholding Structure l Business Review l Corporate Governance l Financial Statements l Other Information l

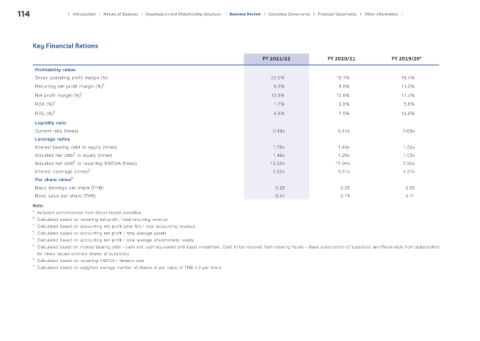

Key Financial Rations

FY 2021/22 FY 2020/21 FY 2019/20 A

Profitability ratios

Gross operating profit margin (%) 22.2% 18.1% 18.4%

Recurring net profit margin (%) B 9.3% 9.6% 11.3%

Net profit margin (%) C 12.3% 10.8% 17.4%

ROA (%) D 1.7% 2.8% 5.6%

ROE (%) E 4.8% 7.5% 14.8%

Liquidity ratio

Current ratio (times) 0.49x 0.44x 0.68x

Leverage ratios

Interest bearing debt to equity (times) 1.76x 1.49x 1.32x

Adjusted net debt to equity (times) 1.46x 1.28x 1.05x

F

Adjusted net debt to recurring EBITDA (times) 15.50x 11.04x 7.35x

F

Interest coverage (times) G 2.52x 3.51x 4.27x

Per share ratios H

Basic earnings per share (THB) 0.29 0.35 0.65

Book value per share (THB) 6.54 5.78 5.11

Note:

A Included performances from discontinued operation

B Calculated based on recurring net profit / total recurring revenue

C Calculated based on accounting net profit (after MI) / total accounting revenue

D Calculated based on accounting net profit / total average assets

E Calculated based on accounting net profit / total average shareholders’ equity

F Calculated based on interest bearing debt - cash and cash equivalent and liquid investment, Cash to be received from clearing house - share subscription of subsidiary and Receivable from subscription

for newly issued ordinary shares of subsidiary

G Calculated based on recurring EBITDA / finance cost

H Calculated based on weighted average number of shares at par value of THB 4.0 per share