Page 121 - BTSGroup ONE REPORT 2021/22_EN

P. 121

BTS Group Holdings Public Company Limited 4.4 Management Discussion and Analysis 119

Annual Report 2021/22

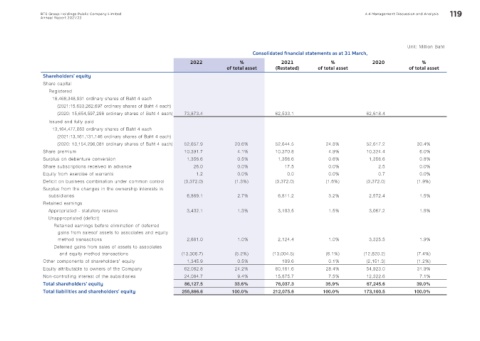

Unit: Million Baht

Consolidated financial statements as at 31 March,

2022 % 2021 % 2020 %

of total asset (Restated) of total asset of total asset

Shareholders' equity

Share capital

Registered

18,468,348,931 ordinary shares of Baht 4 each

(2021:15,633,262,697 ordinary shares of Baht 4 each)

(2020: 15,654,597,298 ordinary shares of Baht 4 each) 73,873.4 62,533.1 62,618.4

Issued and fully paid

13,164,477,883 ordinary shares of Baht 4 each

(2021:13,161,131,146 ordinary shares of Baht 4 each)

(2020: 13,154,296,081 ordinary shares of Baht 4 each) 52,657.9 20.6% 52,644.5 24.8% 52,617.2 30.4%

Share premium 10,391.7 4.1% 10,370.8 4.9% 10,324.4 6.0%

Surplus on debenture conversion 1,356.6 0.5% 1,356.6 0.6% 1,356.6 0.8%

Share subscriptions received in advance 26.0 0.0% 17.5 0.0% 2.5 0.0%

Equity from exercise of warrants 1.2 0.0% 0.0 0.0% 0.7 0.0%

Deficit on business combination under common control (3,372.0) (1.3%) (3,372.0) (1.6%) (3,372.0) (1.9%)

Surplus from the changes in the ownership interests in

subsidiaries 6,869.1 2.7% 6,811.2 3.2% 2,572.4 1.5%

Retained earnings

Appropriated - statutory reserve 3,432.1 1.3% 3,103.5 1.5% 3,067.2 1.8%

Unappropriated (deficit)

Retained earnings before elimination of deferred

gains from salesof assets to associates and equity

method transactions 2,661.0 1.0% 2,124.4 1.0% 3,325.5 1.9%

Deferred gains from sales of assets to associates

and equity method transactions (13,306.7) (5.2%) (13,004.5) (6.1%) (12,820.2) (7.4%)

Other components of shareholders' equity 1,345.9 0.5% 109.6 0.1% (2,151.3) (1.2%)

Equity attributable to owners of the Company 62,062.8 24.2% 60,161.6 28.4% 54,923.0 31.9%

Non-controlling interest of the subsidiaries 24,064.7 9.4% 15,875.7 7.5% 12,322.6 7.1%

Total shareholders' equity 86,127.5 33.6% 76,037.3 35.9% 67,245.6 39.0%

Total liabilities and shareholders' equity 255,866.6 100.0% 212,075.6 100.0% 173,100.5 100.0%