Page 118 - BTSGroup ONE REPORT 2021/22_EN

P. 118

116 l Introduction l Nature of Business l Organisation and Shareholding Structure l Business Review l Corporate Governance l Financial Statements l Other Information l

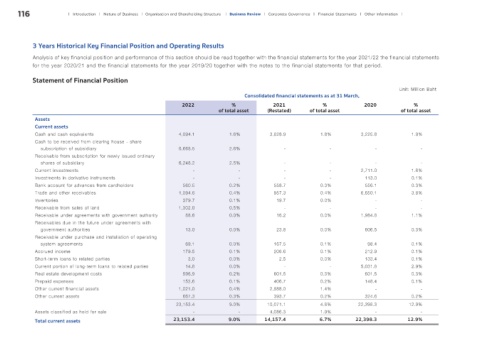

3 Years Historical Key Financial Position and Operating Results

Analysis of key financial position and performance of this section should be read together with the financial statements for the year 2021/22 the financial statements

for the year 2020/21 and the financial statements for the year 2019/20 together with the notes to the financial statements for that period.

Statement of Financial Position

Unit: Million Baht

Consolidated financial statements as at 31 March,

2022 % 2021 % 2020 %

of total asset (Restated) of total asset of total asset

Assets

Current assets

Cash and cash equivalents 4,094.1 1.6% 3,828.9 1.8% 3,225.8 1.9%

Cash to be received from clearing house - share

subscription of subsidiary 6,668.5 2.6% - - - -

Receivable from subscription for newly issued ordinary

shares of subsidiary 6,248.2 2.5% - - - -

Current investments - - - - 2,711.0 1.6%

Investments in derivative instruments - - - - 113.0 0.1%

Bank account for advances from cardholders 560.5 0.2% 558.7 0.3% 556.1 0.3%

Trade and other receivables 1,094.6 0.4% 957.3 0.4% 6,650.1 3.8%

Inventories 379.7 0.1% 19.7 0.0% - -

Receivable from sales of land 1,302.0 0.5% - - - -

Receivable under agreements with government authority 88.6 0.0% 16.2 0.0% 1,984.8 1.1%

Receivables due in the future under agreements with

government authorities 13.0 0.0% 23.8 0.0% 606.5 0.3%

Receivable under purchase and installation of operating

system agreements 69.1 0.0% 167.5 0.1% 98.4 0.1%

Accrued income 179.5 0.1% 206.6 0.1% 212.9 0.1%

Short-term loans to related parties 3.0 0.0% 2.5 0.0% 133.4 0.1%

Current portion of long-term loans to related parties 14.8 0.0% - - 5,031.8 2.9%

Real estate development costs 596.9 0.2% 601.5 0.3% 601.5 0.3%

Prepaid expenses 152.6 0.1% 406.7 0.2% 148.4 0.1%

Other current financial assets 1,021.0 0.4% 2,888.0 1.4% - -

Other current assets 667.3 0.3% 393.7 0.2% 324.6 0.2%

23,153.4 9.0% 10,071.1 4.8% 22,398.3 12.9%

Assets classified as held for sale - - 4,086.3 1.9% - -

Total current assets 23,153.4 9.0% 14,157.4 6.7% 22,398.3 12.9%