Page 310 - BTSGroup ONE REPORT 2021/22_EN

P. 310

308 l Introduction l Nature of Business l Organisation and Shareholding Structure l Business Review l Corporate Governance l Financial Statements l Other Information l

Special Business Tax of BTS Rail Mass Transit Growth Infrastructure Major maintenance or restoration of elevated train projects under service

Fund (“BTSGIF”) concession

A subsidiary (BTSC) recognised a provision for future special business The subsidiary (BTSC) recognises a provision for its contractual

tax liabilities of BTSGIF over the remaining period of the Core obligation to perform major maintenance or restoration on elevated train

Bangkok Mass Transit System, since under the Net Revenue Purchase projects under the service concession. During the year, the subsidiary

and Transfer Agreement, the subsidiary is responsible for this tax. has recorded reversal of the provision amounting to Baht 34 million,

In calculating the provision for special business tax, the subsidiary referred presented in the statement of comprehensive income for the current

to projections of future revenues prepared by an independent valuer and year.

amortisation of BTSGIF’s investment in rights to receive fare box revenue

of the Core Bangkok Mass Transit System of BTSGIF, discounted to Construction cost of carpark building and skywalk

present value. During the year, the subsidiary recorded reversal of the The subsidiary (Mo Chit Land) recorded provision for its contractual

provision amounting to Baht 107 million, presented in the statement of obligations with a bank to construct a car park building and sky walk.

comprehensive income for the current year.

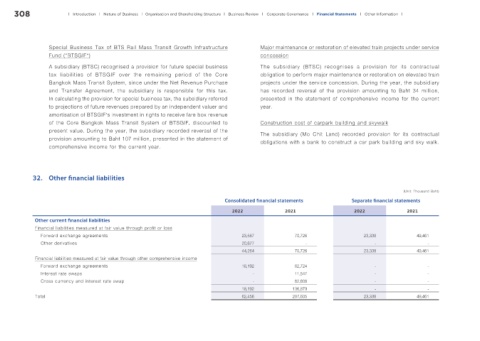

32. Other f nancial liabilities

(Unit: Thousand Baht)

Consolidated f nancial statements Separate f nancial statements

2022 2021 2022 2021

Other current f nancial liabilities

Financial liabilities measured at fair value through profit or loss

Forward exchange agreements 23,587 70,726 23,338 49,461

Other derivatives 20,677 - - -

44,264 70,726 23,338 49,461

Financial liabilities measured at fair value through other comprehensive income

Forward exchange agreements 18,192 62,724 - -

Interest rate swaps - 11,547 - -

Cross currency and interest rate swap - 62,608 - -

18,192 136,879 - -

Total 62,456 207,605 23,338 49,461