Page 313 - BTSGroup ONE REPORT 2021/22_EN

P. 313

BTS Group Holdings Public Company Limited 6.4 Notes to Consolidated Financial Statements 311

Annual Report 2021/22

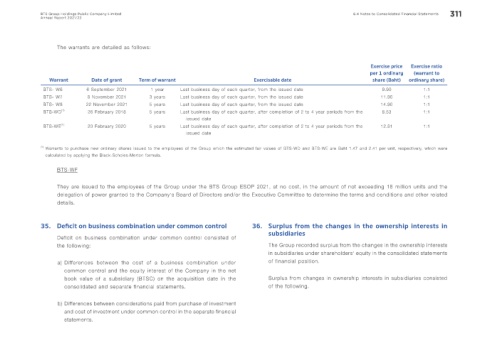

The warrants are detailed as follows:

Exercise price Exercise ratio

per 1 ordinary (warrant to

Warrant Date of grant Term of warrant Exercisable date share (Baht) ordinary share)

BTS- W6 6 September 2021 1 year Last business day of each quarter, from the issued date 9.90 1:1

BTS- W7 8 November 2021 3 years Last business day of each quarter, from the issued date 11.90 1:1

BTS- W8 22 November 2021 5 years Last business day of each quarter, from the issued date 14.90 1:1

BTS-WD (1) 26 February 2018 5 years Last business day of each quarter, after completion of 2 to 4 year periods from the 8.53 1:1

issued date

BTS-WE (1) 20 February 2020 5 years Last business day of each quarter, after completion of 2 to 4 year periods from the 12.81 1:1

issued date

(1) Warrants to purchase new ordinary shares issued to the employees of the Group which the estimated fair values of BTS-WD and BTS-WE are Baht 1.47 and 2.41 per unit, respectively, which were

calculated by applying the Black-Scholes-Merton formula.

BTS-WF

They are issued to the employees of the Group under the BTS Group ESOP 2021, at no cost, in the amount of not exceeding 18 million units and the

delegation of power granted to the Company’s Board of Directors and/or the Executive Committee to determine the terms and conditions and other related

details.

35. Def cit on business combination under common control 36. Surplus from the changes in the ownership interests in

Deficit on business combination under common control consisted of subsidiaries

the following: The Group recorded surplus from the changes in the ownership interests

in subsidiaries under shareholders’ equity in the consolidated statements

a) Differences between the cost of a business combination under of financial position.

common control and the equity interest of the Company in the net

book value of a subsidiary (BTSC) on the acquisition date in the Surplus from changes in ownership interests in subsidiaries consisted

consolidated and separate financial statements. of the following.

b) Differences between considerations paid from purchase of investment

and cost of investment under common control in the separate financial

statements.