Page 314 - BTSGroup ONE REPORT 2021/22_EN

P. 314

312 l Introduction l Nature of Business l Organisation and Shareholding Structure l Business Review l Corporate Governance l Financial Statements l Other Information l

a) The differences between the net considerations paid or received as 38. Statutory reserve and unappropriated retained earnings

a result of changes in ownership interests in the subsidiaries and the

non-controlling interests of the subsidiaries at the net book value of

the subsidiaries as at the date of change. Non-controlling interests 38.1 Statutory reserve

of the subsidiaries were measured at the value of the identifiable net Pursuant to Section 116 of the Public Limited Companies Act B.E.

assets of the subsidiaries in proportion to the shareholding of the 2535, the Company is required to set aside to a statutory reserve at

non-controlling interests. least 5% of its net profit after deducting accumulated deficit brought

forward (if any), until the reserve reaches 10% of the registered capital.

b) The net considerations received as a result of sales of warrants The statutory reserve is not available for dividend distribution.

of the subsidiary, which are deemed to constitute a change in the

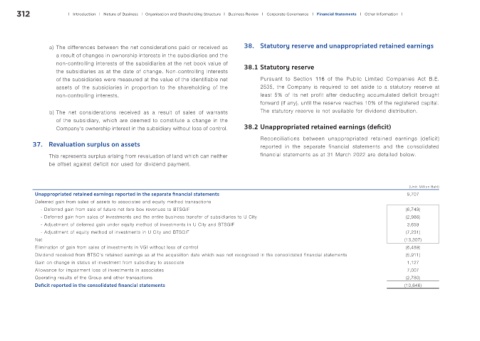

Company’s ownership interest in the subsidiary without loss of control. 38.2 Unappropriated retained earnings (def cit)

Reconciliations between unappropriated retained earnings (deficit)

37. Revaluation surplus on assets reported in the separate financial statements and the consolidated

This represents surplus arising from revaluation of land which can neither financial statements as at 31 March 2022 are detailed below.

be offset against deficit nor used for dividend payment.

(Unit: Million Baht)

Unappropriated retained earnings reported in the separate f nancial statements 9,707

Deferred gain from sales of assets to associates and equity method transactions

- Deferred gain from sale of future net fare box revenues to BTSGIF (6,749)

- Deferred gain from sales of investments and the entire business transfer of subsidiaries to U City (2,986)

- Adjustment of deferred gain under equity method of investments in U City and BTSGIF 3,659

- Adjustment of equity method of investments in U City and BTSGIF (7,231)

Net (13,307)

Elimination of gain from sales of investments in VGI without loss of control (6,489)

Dividend received from BTSC’s retained earnings as at the acquisition date which was not recognised in the consolidated financial statements (5,911)

Gain on change in status of investment from subsidiary to associate 1,127

Allowance for impairment loss of investments in associates 7,007

Operating results of the Group and other transactions (2,780)

Def cit reported in the consolidated f nancial statements (10,646)