Page 318 - BTSGroup ONE REPORT 2021/22_EN

P. 318

316 l Introduction l Nature of Business l Organisation and Shareholding Structure l Business Review l Corporate Governance l Financial Statements l Other Information l

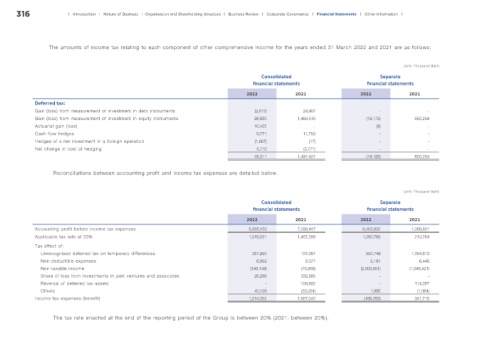

The amounts of income tax relating to each component of other comprehensive income for the years ended 31 March 2022 and 2021 are as follows:

(Unit: Thousand Baht)

Consolidated Separate

f nancial statements f nancial statements

2022 2021 2022 2021

Deferred tax:

Gain (loss) from measurement of investment in debt instruments (2,615) 24,907 - -

Gain (loss) from measurement of investment in equity instruments 26,680 1,464,515 (19,172) 650,254

Actuarial gain (loss) 10,432 - (8) -

Cash flow hedges 9,771 11,793 - -

Hedges of a net investment in a foreign operation (1,667) (17) - -

Net change in cost of hedging 5,710 (3,771) - -

48,311 1,497,427 (19,180) 650,254

Reconciliations between accounting profit and income tax expenses are detailed below.

(Unit: Thousand Baht)

Consolidated Separate

f nancial statements f nancial statements

2022 2021 2022 2021

Accounting profit before income tax expenses 5,095,153 7,286,447 6,403,832 1,068,821

Applicable tax rate at 20% 1,019,031 1,457,289 1,280,766 213,764

Tax effect of:

Unrecognised deferred tax on temporary differences 267,950 122,387 552,749 1,054,613

Non-deductible expenses 6,953 8,077 5,191 6,446

Non-taxable income (146,149) (70,866) (2,008,951) (1,046,421)

Share of loss from investments in joint ventures and associates 26,288 332,885 - -

Reversal of deferred tax assets - 109,692 - 114,357

Others 40,129 (33,024) 1,995 (1,064)

Income tax expenses (benefit) 1,214,202 1,927,040 (168,250) 341,715

The tax rate enacted at the end of the reporting period of the Group is between 20% (2021: between 20%).