Page 317 - BTSGroup ONE REPORT 2021/22_EN

P. 317

BTS Group Holdings Public Company Limited 6.4 Notes to Consolidated Financial Statements 315

Annual Report 2021/22

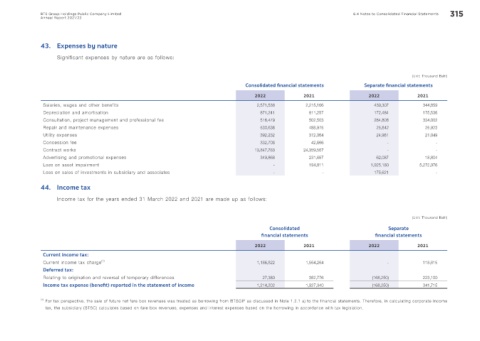

43. Expenses by nature

Significant expenses by nature are as follows:

(Unit: Thousand Baht)

Consolidated f nancial statements Separate f nancial statements

2022 2021 2022 2021

Salaries, wages and other benefits 2,571,538 2,215,166 439,307 344,859

Depreciation and amortisation 871,241 811,257 172,484 175,536

Consultation, project management and professional fee 516,479 502,503 284,808 334,002

Repair and maintenance expenses 530,636 488,975 25,842 25,923

Utility expenses 392,232 372,064 24,981 21,049

Concession fee 332,706 42,666 - -

Contract works 13,847,783 24,359,567 - -

Advertising and promotional expenses 349,868 231,687 62,087 18,804

Loss on asset impairment - 194,811 1,925,180 5,272,976

Loss on sales of investments in subsidiary and associates - - 175,621 -

44. Income tax

Income tax for the years ended 31 March 2022 and 2021 are made up as follows:

(Unit: Thousand Baht)

Consolidated Separate

f nancial statements f nancial statements

2022 2021 2022 2021

Current income tax:

Current income tax charge (1) 1,186,822 1,564,264 - 118,615

Deferred tax:

Relating to origination and reversal of temporary differences 27,380 362,776 (168,250) 223,100

Income tax expense (benef t) reported in the statement of income 1,214,202 1,927,040 (168,250) 341,715

(1) For tax perspective, the sale of future net fare box revenues was treated as borrowing from BTSGIF as discussed in Note 1.2.1 a) to the financial statements. Therefore, in calculating corporate income

tax, the subsidiary (BTSC) calculates based on fare box revenues, expenses and interest expenses based on the borrowing in accordance with tax legislation.