Page 319 - BTSGroup ONE REPORT 2021/22_EN

P. 319

BTS Group Holdings Public Company Limited 6.4 Notes to Consolidated Financial Statements 317

Annual Report 2021/22

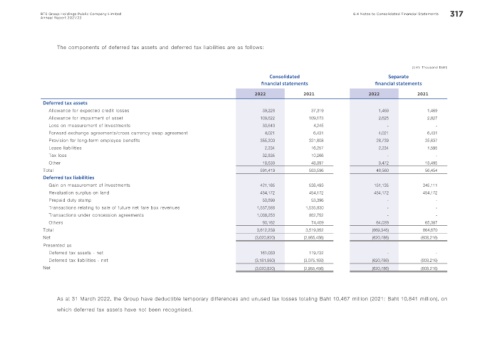

The components of deferred tax assets and deferred tax liabilities are as follows:

(Unit: Thousand Baht)

Consolidated Separate

f nancial statements f nancial statements

2022 2021 2022 2021

Deferred tax assets

Allowance for expected credit losses 39,228 37,319 1,469 1,469

Allowance for impairment of asset 108,622 109,173 2,625 2,827

Loss on measurement of investments 30,640 4,245 - -

Forward exchange agreements/cross currency swap agreement 4,021 6,431 4,021 6,431

Provision for long-term employee benefits 355,200 331,808 28,739 25,637

Lease liabilities 2,234 16,257 2,234 1,595

Tax loss 32,835 10,266 - -

Other 18,639 48,097 9,472 18,495

Total 591,419 563,596 48,560 56,454

Deferred tax liabilities

Gain on measurement of investments 421,165 538,493 151,135 345,111

Revaluation surplus on land 454,172 454,172 454,172 454,172

Prepaid duty stamp 50,899 53,396 - -

Transactions relating to sale of future net fare box revenues 1,557,588 1,535,830 - -

Transactions under concession agreements 1,038,253 862,752 - -

Others 90,162 74,409 64,039 65,387

Total 3,612,239 3,519,052 (669,346) 864,670

Net (3,020,820) (2,955,456) (620,786) (808,216)

Presented as

Deferred tax assets - net 161,030 119,732 - -

Deferred tax liabilities - net (3,181,850) (3,075,188) (620,786) (808,216)

Net (3,020,820) (2,955,456) (620,786) (808,216)

As at 31 March 2022, the Group have deductible temporary differences and unused tax losses totaling Baht 10,467 million (2021: Baht 10,841 million), on

which deferred tax assets have not been recognised.