Page 328 - BTSGroup ONE REPORT 2021/22_EN

P. 328

326 l Introduction l Nature of Business l Organisation and Shareholding Structure l Business Review l Corporate Governance l Financial Statements l Other Information l

In this regard, VGI and the legal consultant of VGI had a different Civil Court. Subsequently, on 5 April 2022, the Supreme Court has

opinion from such arbitration award and are of the view that the said dismissed Midas’s petition by not allowing Midas to appeal to the

arbitration award may be both factually and legally deviated. As such, Supreme Court further. As a result, this case can be considered as

on 5 May 2020, VGI filed the motion to the Civil Court to abrogate final at this stage.

the said arbitration award.

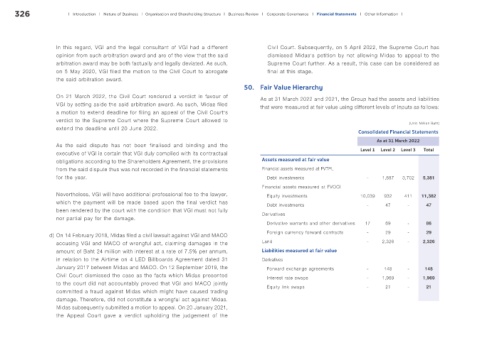

50. Fair Value Hierarchy

On 21 March 2022, the Civil Court rendered a verdict in favour of As at 31 March 2022 and 2021, the Group had the assets and liabilities

VGI by setting aside the said arbitration award. As such, Midas filed that were measured at fair value using different levels of inputs as follows:

a motion to extend deadline for filing an appeal of the Civil Court’s

verdict to the Supreme Court where the Supreme Court allowed to (Unit: Million Baht)

extend the deadline until 20 June 2022.

Consolidated Financial Statements

As the said dispute has not been finalised and binding and the As at 31 March 2022

executive of VGI is certain that VGI duly complied with its contractual Level 1 Level 2 Level 3 Total

obligations according to the Shareholders Agreement, the provisions Assets measured at fair value

from the said dispute thus was not recorded in the financial statements Financial assets measured at FVTPL

for the year. Debt investments - 1,887 3,702 5,381

Financial assets measured at FVOCI

Nevertheless, VGI will have additional professional fee to the lawyer, Equity investments 10,039 932 411 11,382

which the payment will be made based upon the final verdict has Debt investments - 47 - 47

been rendered by the court with the condition that VGI must not fully

nor partial pay for the damage. Derivatives

Derivative warrants and other derivatives 17 69 - 86

d) On 14 February 2018, Midas filed a civil lawsuit against VGI and MACO Foreign currency forward contracts - 29 - 29

accusing VGI and MACO of wrongful act, claiming damages in the Land - 2,326 - 2,326

amount of Baht 24 million with interest at a rate of 7.5% per annum, Liabilities measured at fair value

in relation to the Airtime on 4 LED Billboards Agreement dated 31 Derivatives

January 2017 between Midas and MACO. On 12 September 2019, the Forward exchange agreements - 148 - 148

Civil Court dismissed the case as the facts which Midas presented Interest rate swaps - 1,969 - 1,969

to the court did not accountably proved that VGI and MACO jointly Equity link swaps - 21 - 21

committed a fraud against Midas which might have caused trading

damage. Therefore, did not constitute a wrongful act against Midas.

Midas subsequently submitted a motion to appeal. On 20 January 2021,

the Appeal Court gave a verdict upholding the judgement of the