Page 331 - BTSGroup ONE REPORT 2021/22_EN

P. 331

BTS Group Holdings Public Company Limited 6.4 Notes to Consolidated Financial Statements 329

Annual Report 2021/22

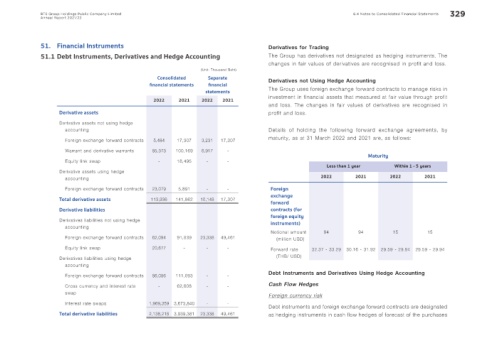

51. Financial Instruments Derivatives for Trading

51.1 Debt Instruments, Derivatives and Hedge Accounting The Group has derivatives not designated as hedging instruments. The

changes in fair values of derivatives are recognised in profit and loss.

(Unit: Thousand Baht)

Consolidated Separate Derivatives not Using Hedge Accounting

f nancial statements f nancial The Group uses foreign exchange forward contracts to manage risks in

statements

investment in financial assets that measured at fair value through profit

2022 2021 2022 2021

and loss. The changes in fair values of derivatives are recognised in

Derivative assets profit and loss.

Derivative assets not using hedge

accounting Details of holding the following forward exchange agreements, by

Foreign exchange forward contracts 5,484 17,307 3,231 17,307 maturity, as at 31 March 2022 and 2021 are, as follows:

Warrant and derivative warrants 85,373 100,169 6,917 -

Maturity

Equity link swap - 18,495 - -

Less than 1 year Within 1 - 5 years

Derivative assets using hedge

accounting 2022 2021 2022 2021

Foreign exchange forward contracts 23,079 5,891 - - Foreign

Total derivative assets 113,936 141,862 10,148 17,307 exchange

forward

Derivative liabilities contracts (for

Derivatives liabilities not using hedge foreign equity

accounting instruments)

Notional amount 94 94 15 15

Foreign exchange forward contracts 62,094 91,839 23,338 49,461 (million USD)

Equity link swap 20,677 - - - Forward rate 32.37 - 33.29 30.16 - 31.92 29.59 - 29.94 29.59 - 29.94

Derivatives liabilities using hedge (THB/ USD)

accounting

Foreign exchange forward contracts 86,086 111,093 - - Debt Instruments and Derivatives Using Hedge Accounting

Cross currency and interest rate - 62,608 - - Cash Flow Hedges

swap Foreign currency risk

Interest rate swaps 1,969,359 3,673,840 - -

Debt instruments and foreign exchange forward contracts are designated

Total derivative liabilities 2,138,216 3,939,381 23,338 49,461 as hedging instruments in cash flow hedges of forecast of the purchases