Page 335 - BTSGroup ONE REPORT 2021/22_EN

P. 335

BTS Group Holdings Public Company Limited 6.4 Notes to Consolidated Financial Statements 333

Annual Report 2021/22

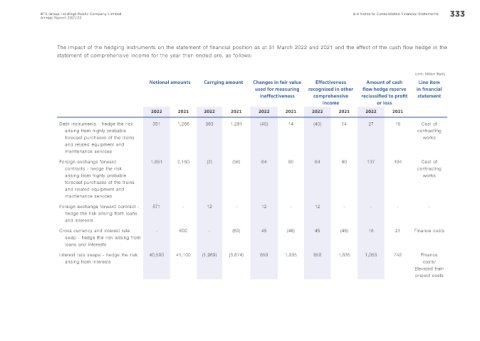

The impact of the hedging instruments on the statement of financial position as at 31 March 2022 and 2021 and the effect of the cash flow hedge in the

statement of comprehensive income for the year then ended are, as follows:

(Unit: Million Baht)

Notional amounts Carrying amount Changes in fair value Effectiveness Amount of cash Line item

used for measuring recognised in other f ow hedge reserve in f nancial

ineffectiveness comprehensive reclassif ed to prof t statement

income or loss

2022 2021 2022 2021 2022 2021 2022 2021 2022 2021

Debt instruments - hedge the risk 351 1,266 363 1,291 (40) 14 (40) 14 27 10 Cost of

arising from highly probable contracting

forecast purchases of the trains works

and related equipment and

maintenance services

Foreign exchange forward 1,851 2,160 (2) (56) 64 80 64 80 137 194 Cost of

contracts - hedge the risk contracting

arising from highly probable works

forecast purchases of the trains

and related equipment and

maintenance services

Foreign exchange forward contract - 571 - 12 - 12 - 12 - - - -

hedge the risk arising from loans

and interests

Cross currency and interest rate - 600 - (63) 45 (46) 45 (46) 18 21 Finance costs

swap - hedge the risk arising from

loans and interests

Interest rate swaps - hedge the risk 40,500 41,100 (1,969) (3,674) 650 1,835 650 1,835 1,053 742 Finance

arising from interests costs/

Elevated train

project costs