Page 336 - BTSGroup ONE REPORT 2021/22_EN

P. 336

334 l Introduction l Nature of Business l Organisation and Shareholding Structure l Business Review l Corporate Governance l Financial Statements l Other Information l

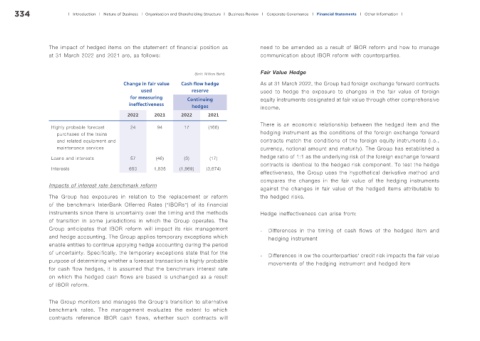

The impact of hedged items on the statement of financial position as need to be amended as a result of IBOR reform and how to manage

at 31 March 2022 and 2021 are, as follows: communication about IBOR reform with counterparties.

(Unit: Million Baht) Fair Value Hedge

Change in fair value Cash f ow hedge As at 31 March 2022, the Group had foreign exchange forward contracts

used reserve used to hedge the exposure to changes in the fair value of foreign

for measuring Continuing equity instruments designated at fair value through other comprehensive

ineffectiveness hedges income.

2022 2021 2022 2021

There is an economic relationship between the hedged item and the

Highly probable forecast 24 94 17 (168)

purchases of the trains hedging instrument as the conditions of the foreign exchange forward

and related equipment and contracts match the conditions of the foreign equity instruments (i.e.,

maintenance services currency, notional amount and maturity). The Group has established a

Loans and interests 57 (46) (3) (17) hedge ratio of 1:1 as the underlying risk of the foreign exchange forward

contracts is identical to the hedged risk component. To test the hedge

Interests 650 1,835 (1,969) (3,674)

effectiveness, the Group uses the hypothetical derivative method and

compares the changes in the fair value of the hedging instruments

Impacts of interest rate benchmark reform against the changes in fair value of the hedged items attributable to

The Group has exposures in relation to the replacement or reform the hedged risks.

of the benchmark InterBank Offerred Rates (“IBORs”) of its financial

instruments since there is uncertainty over the timing and the methods Hedge ineffectiveness can arise from:

of transition in some jurisdictions in which the Group operates. The

Group anticipates that IBOR reform will impact its risk management - Differences in the timing of cash flows of the hedged item and

and hedge accounting. The Group applies temporary exceptions which hedging instrument

enable entities to continue applying hedge accounting during the period

of uncertainty. Specifically, the temporary exceptions state that for the - Differences in ow the counterparties’ credit risk impacts the fair value

purpose of determining whether a forecast transaction is highly probable movements of the hedging instrument and hedged item

for cash flow hedges, it is assumed that the benchmark interest rate

on which the hedged cash flows are based is unchanged as a result

of IBOR reform.

The Group monitors and manages the Group’s transition to alternative

benchmark rates. The management evaluates the extent to which

contracts reference IBOR cash flows, whether such contracts will