Page 338 - BTSGroup ONE REPORT 2021/22_EN

P. 338

336 l Introduction l Nature of Business l Organisation and Shareholding Structure l Business Review l Corporate Governance l Financial Statements l Other Information l

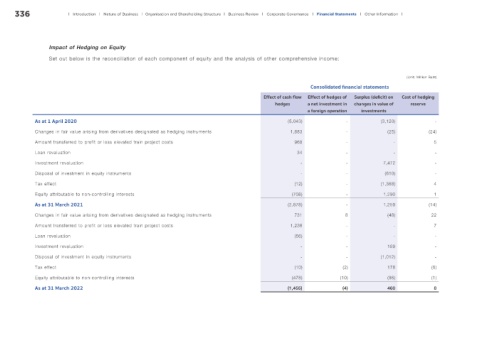

Impact of Hedging on Equity

Set out below is the reconciliation of each component of equity and the analysis of other comprehensive income:

(Unit: Million Baht)

Consolidated f nancial statements

Effect of cash f ow Effect of hedges of Surplus (def cit) on Cost of hedging

hedges a net investment in changes in value of reserve

a foreign operation investments

As at 1 April 2020 (5,043) - (3,120) -

Changes in fair value arising from derivatives designated as hedging instruments 1,883 - (25) (24)

Amount transferred to profit or loss elevated train project costs 968 - - 5

Loan revaluation 34 - - -

Investment revaluation - - 7,472 -

Disposal of investment in equity instruments - - (610) -

Tax effect (12) - (1,368) 4

Equity attributable to non-controlling interests (708) - 1,290 1

As at 31 March 2021 (2,878) - 1,259 (14)

Changes in fair value arising from derivatives designated as hedging instruments 731 8 (48) 22

Amount transferred to profit or loss elevated train project costs 1,236 - - 7

Loan revaluation (56) - - -

Investment revaluation - - 169 -

Disposal of investment in equity instruments - - (1,012) -

Tax effect (10) (2) 178 (6)

Equity attributable to non-controlling interests (478) (10) (86) (1)

As at 31 March 2022 (1,455) (4) 460 8