Page 337 - BTSGroup ONE REPORT 2021/22_EN

P. 337

BTS Group Holdings Public Company Limited 6.4 Notes to Consolidated Financial Statements 335

Annual Report 2021/22

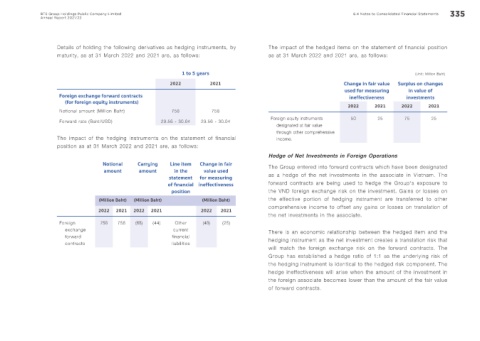

Details of holding the following derivatives as hedging instruments, by The impact of the hedged items on the statement of financial position

maturity, as at 31 March 2022 and 2021 are, as follows: as at 31 March 2022 and 2021 are, as follows:

1 to 5 years (Unit: Million Baht)

2022 2021 Change in fair value Surplus on changes

used for measuring in value of

Foreign exchange forward contracts ineffectiveness investments

(for foreign equity instruments)

2022 2021 2022 2021

Notional amount (Million Baht) 758 758

Forward rate (Baht/USD) 29.56 - 30.04 29.56 - 30.04 Foreign equity instruments 50 25 75 25

designated at fair value

through other comprehensive

The impact of the hedging instruments on the statement of financial income.

position as at 31 March 2022 and 2021 are, as follows:

Hedge of Net Investments in Foreign Operations

Notional Carrying Line item Change in fair The Group entered into forward contracts which have been designated

amount amount in the value used as a hedge of the net investments in the associate in Vietnam. The

statement for measuring

of f nancial ineffectiveness forward contracts are being used to hedge the Group’s exposure to

position the VND foreign exchange risk on the investment. Gains or losses on

the effective portion of hedging instrument are transferred to other

(Million Baht) (Million Baht) (Million Baht)

comprehensive income to offset any gains or losses on translation of

2022 2021 2022 2021 2022 2021

the net investments in the associate.

Foreign 758 758 (68) (44) Other (48) (25)

exchange current There is an economic relationship between the hedged item and the

forward financial hedging instrument as the net investment creates a translation risk that

contracts liabilities

will match the foreign exchange risk on the forward contracts. The

Group has established a hedge ratio of 1:1 as the underlying risk of

the hedging instrument is identical to the hedged risk component. The

hedge ineffectiveness will arise when the amount of the investment in

the foreign associate becomes lower than the amount of the fair value

of forward contracts.