Page 340 - BTSGroup ONE REPORT 2021/22_EN

P. 340

338 l Introduction l Nature of Business l Organisation and Shareholding Structure l Business Review l Corporate Governance l Financial Statements l Other Information l

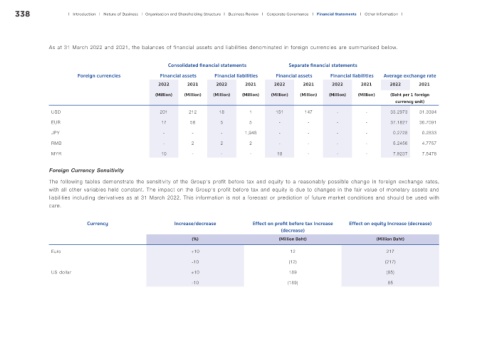

As at 31 March 2022 and 2021, the balances of financial assets and liabilities denominated in foreign currencies are summarised below.

Consolidated f nancial statements Separate f nancial statements

Foreign currencies Financial assets Financial liabilities Financial assets Financial liabilities Average exchange rate

2022 2021 2022 2021 2022 2021 2022 2021 2022 2021

(Million) (Million) (Million) (Million) (Million) (Million) (Million) (Million) (Baht per 1 foreign

currency unit)

USD 201 212 18 1 151 147 - - 33.2973 31.3394

EUR 17 58 5 5 - - - - 37.1827 36.7091

JPY - - - 1,948 - - - - 0.2728 0.2833

RMB - 2 2 2 - - - - 5.2456 4.7757

MYR 10 - - - 10 - - - 7.9237 7.5478

Foreign Currency Sensitivity

The following tables demonstrate the sensitivity of the Group’s profit before tax and equity to a reasonably possible change in foreign exchange rates,

with all other variables held constant. The impact on the Group’s profit before tax and equity is due to changes in the fair value of monetary assets and

liabilities including derivatives as at 31 March 2022. This information is not a forecast or prediction of future market conditions and should be used with

care.

Currency Increase/decrease Effect on prof t before tax Increase Effect on equity Increase (decrease)

(decrease)

(%) (Million Baht) (Million Baht)

Euro +10 12 217

-10 (12) (217)

US dollar +10 189 (85)

-10 (189) 85