Page 330 - BTSGroup ONE REPORT 2021/22_EN

P. 330

328 l Introduction l Nature of Business l Organisation and Shareholding Structure l Business Review l Corporate Governance l Financial Statements l Other Information l

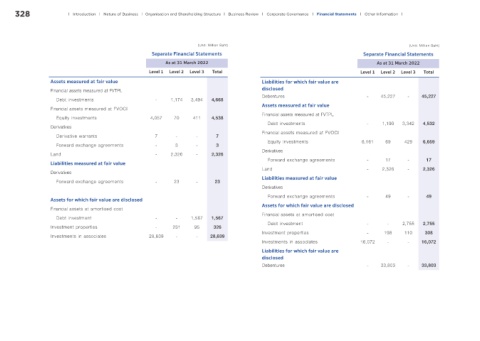

(Unit: Million Baht) (Unit: Million Baht)

Separate Financial Statements Separate Financial Statements

As at 31 March 2022 As at 31 March 2022

Level 1 Level 2 Level 3 Total Level 1 Level 2 Level 3 Total

Assets measured at fair value Liabilities for which fair value are

Financial assets measured at FVTPL disclosed

Debt investments - 1,174 3,494 4,668 Debentures - 45,227 - 45,227

Financial assets measured at FVOCI Assets measured at fair value

Equity investments 4,057 70 411 4,538 Financial assets measured at FVTPL

Derivatives Debt investments - 1,190 3,342 4,532

Derivative warrants 7 - - 7 Financial assets measured at FVOCI

Forward exchange agreements - 3 - 3 Equity investments 6,161 69 429 6,659

Land - 2,326 - 2,326 Derivatives

Forward exchange agreements - 17 - 17

Liabilities measured at fair value

Derivatives Land - 2,326 - 2,326

Forward exchange agreements - 23 - 23 Liabilities measured at fair value

Derivatives

Forward exchange agreements - 49 - 49

Assets for which fair value are disclosed

Financial assets at amortised cost Assets for which fair value are disclosed

Debt investment - - 1,567 1,567 Financial assets at amortised cost

Investment properties - 231 95 326 Debt investment - - 2,755 2,755

Investments in associates 28,639 - - 28,639 Investment properties - 198 110 308

Investments in associates 16,072 - - 16,072

Liabilities for which fair value are

disclosed

Debentures - 33,803 - 33,803