Page 216 - BTSGroup ONE REPORT 2021/22_EN

P. 216

214 l Introduction l Nature of Business l Organisation and Shareholding Structure l Business Review l Corporate Governance l Financial Statements l Other Information l

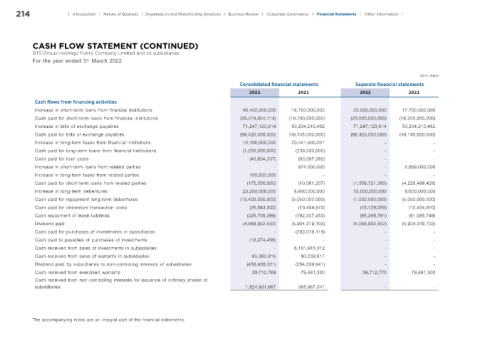

CASH FLOW STATEMENT (CONTINUED)

BTS Group Holdings Public Company Limited and its subsidiaries

For the year ended 31 March 2022

(Unit: Baht)

Consolidated f nancial statements Separate f nancial statements

2022 2021 2022 2021

Cash f ows from f nancing activities

Increase in short-term loans from financial institutions 40,400,000,000 18,750,000,000 23,000,000,000 17,700,000,000

Cash paid for short-term loans from financial institutions (26,279,924,714) (19,700,000,000) (20,000,000,000) (18,200,000,000)

Increase in bills of exchange payables 71,247,123,814 50,204,210,482 71,247,123,814 50,204,210,482

Cash paid for bills of exchange payables (66,420,000,000) (49,145,000,000) (66,420,000,000) (49,145,000,000)

Increase in long-term loans from financial institutions 10,106,000,000 20,441,500,001 - -

Cash paid for long-term loans from financial institutions (1,200,000,000) (239,000,000) - -

Cash paid for loan costs (40,634,337) (83,087,390) - -

Increase in short-term loans from related parties - 974,000,000 - 5,889,000,000

Increase in long-term loans from related parties 100,632,500 - - -

Cash paid for short-term loans from related parties (175,000,000) (10,061,207) (1,356,721,380) (4,225,499,428)

Increase in long-term debentures 23,200,000,000 8,600,000,000 13,000,000,000 8,600,000,000

Cash paid for repayment long-term debentures (13,400,000,000) (5,050,000,000) (1,000,000,000) (5,050,000,000)

Cash paid for debenture transaction costs (26,643,000) (10,454,970) (15,729,000) (10,454,970)

Cash repayment of lease liabilities (225,706,369) (192,307,453) (65,389,791) (51,085,749)

Dividend paid (4,068,902,552) (5,904,319,103) (4,068,902,552) (5,904,319,103)

Cash paid for purchases of investments in subsidiaries - (293,079,119) - -

Cash paid to payables of purchases of investments (18,274,456) - - -

Cash received from sales of investments in subsidiaries - 8,101,941,012 - -

Cash received from sales of warrants in subsidiaries 65,382,815 80,239,617 - -

Dividend paid by subsidiaries to non-controling interests of subsidiaries (458,438,321) (284,239,941) - -

Cash received from exercised warrants 39,712,769 79,481,300 39,712,770 79,481,300

Cash received from non-controlling interests for issuance of ordinary shares of

subsidiaries 1,524,931,667 365,967,341 - -

The accompanying notes are an integral part of the financial statements.