Page 211 - BTSGroup ONE REPORT 2021/22_EN

P. 211

BTS Group Holdings Public Company Limited 6.3 Financial Statements 209

Annual Report 2021/22

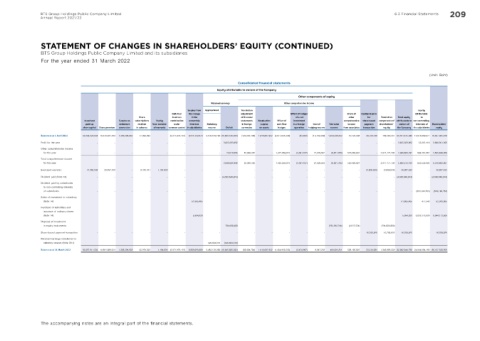

STATEMENT OF CHANGES IN SHAREHOLDERS’ EQUITY (CONTINUED)

BTS Group Holdings Public Company Limited and its subsidiaries

For the year ended 31 March 2022

(Unit: Baht)

Consolidated f nancial statements

Equity attributable to owners of the Company

Other components of equity

Retained earnings Other comprehensive income

Surplus from Appropriated Translation Equity

Def cit on the change adjustment Effect of hedges Share of Capital reserve attributable

Share business in the of f nancial of a net other for Total other Total equity to

Issued and Surplus on subscriptions Equity combination ownership statements Revaluation Effect of investment comprehensive share-based components of attributable to non-controlling

paid-up debenture received from exercise under interests Statutory in foreign surplus cash f ow in a foreign Cost of Fair value income payment shareholders’ owners of interests of Shareholders’

share capital Share premium conversion in advance of warrants common control in subsidiaries reserve Def cit currencies on assets hedges operation hedging reserve reserve from associates transaction equity the Company the subsidiaries equity

Balance as at 1 April 2021 52,644,524,584 10,370,831,183 1,356,596,955 17,494,092 - (3,371,978,137) 6,811,232,974 3,103,519,190 (10,880,126,030) (125,005,146) 1,816,687,952 (2,877,625,348) (83,830) (13,782,289) 1,259,538,352 10,122,398 39,728,148 109,580,237 60,161,675,048 15,875,689,971 76,037,365,019

Profit for the year - - - - - - - - 3,825,583,892 - - - - - - - - - 3,825,583,892 55,367,416 3,880,951,308

Other comprehensive income

for the year - - - - - - - - 23,510,556 62,940,362 - 1,422,659,813 (3,391,167) 21,829,542 (6,921,795) 520,060,981 - 2,017,177,736 2,040,688,292 598,161,067 2,638,849,359

Total comprehensive income

for the year - - - - - - - - 3,849,094,448 62,940,362 - 1,422,659,813 (3,391,167) 21,829,542 (6,921,795) 520,060,981 - 2,017,177,736 5,866,272,184 653,528,483 6,519,800,667

Exercised warrants 13,386,948 20,857,430 - 8,476,431 1,184,693 - - - - - - - - - - - (3,008,040) (3,008,040) 40,897,462 - 40,897,462

Dividend paid (Note 48) - - - - - - - (4,080,649,924) - - - - - - - - - (4,080,649,924) - (4,080,649,924)

Dividend paid by subsidiaries

to non-controlling interests

of subsidiaries - - - - - - - - - - - - - - - - - - - (503,190,764) (503,190,764)

Sales of investment in subsidiary

(Note 14) - - - - - - 51,865,465 - - - - - - - - - - - 51,865,465 477,540 52,343,005

Purchase of subsidiary and

issuance of ordinary shares

(Note 14) - - - - - - 5,994,630 - - - - - - - - - - - 5,994,630 8,038,178,939 8,044,173,569

Disposal of investment

in equity instruments - - - - - - - - 794,600,300 - - - - - (792,582,746) (2,017,554) - (794,600,300) - - -

Share-based payment transaction - - - - - - - - - - - - - - - - 16,789,925 16,789,925 16,789,925 - 16,789,925

Retained earnings transferred to

statutory reserve (Note 38.1) - - - - - - - 328,604,076 (328,604,076) - - - - - - - - - - - -

Balance as at 31 March 2022 52,657,911,532 10,391,688,613 1,356,596,955 25,970,523 1,184,693 (3,371,978,137) 6,869,093,069 3,432,123,266 (10,645,685,282) (62,064,784) 1,816,687,952 (1,454,965,535) (3,474,997) 8,047,253 460,033,811 528,165,825 53,510,033 1,345,939,558 62,062,844,790 24,064,684,169 86,127,528,959

The accompanying notes are an integral part of the financial statements.