Page 208 - BTSGroup ONE REPORT 2021/22_EN

P. 208

206 l Introduction l Nature of Business l Organisation and Shareholding Structure l Business Review l Corporate Governance l Financial Statements l Other Information l

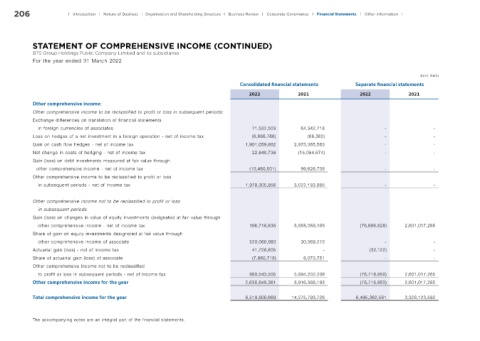

STATEMENT OF COMPREHENSIVE INCOME (CONTINUED)

BTS Group Holdings Public Company Limited and its subsidiaries

For the year ended 31 March 2022

(Unit: Baht)

Consolidated f nancial statements Separate f nancial statements

2022 2021 2022 2021

Other comprehensive income:

Other comprehensive income to be reclassified to profit or loss in subsequent periods:

Exchange differences on translation of financial statements

in foreign currencies of associates 71,532,503 64,342,718 - -

Loss on hedges of a net investment in a foreign operation - net of income tax (6,666,766) (66,360) - -

Gain on cash flow hedges - net of income tax 1,901,059,882 2,873,365,563 - -

Net change in costs of hedging - net of income tax 22,840,738 (15,084,674) - -

Gain (loss) on debt investments measured at fair value through

other comprehensive income - net of income tax (10,460,501) 99,626,738 - -

Other comprehensive income to be reclassified to profit or loss

in subsequent periods - net of income tax 1,978,305,856 3,022,183,985 - -

Other comprehensive income not to be reclassified to profit or loss

in subsequent periods

Gain (loss) on changes in value of equity investments designated at fair value through

other comprehensive income - net of income tax 106,716,635 5,858,059,185 (76,686,828) 2,601,017,265

Share of gain on equity investments designated at fair value through

other comprehensive income of associate 520,060,980 30,069,272 - -

Actuarial gain (loss) - net of income tax 41,726,605 - (32,122) -

Share of actuarial gain (loss) of associate (7,960,715) 6,073,751 - -

Other comprehensive income not to be reclassified

to profit or loss in subsequent periods - net of income tax 660,543,505 5,894,202,208 (76,718,950) 2,601,017,265

Other comprehensive income for the year 2,638,849,361 8,916,386,193 (76,718,950) 2,601,017,265

Total comprehensive income for the year 6,519,800,669 14,275,793,726 6,495,362,561 3,328,123,592

The accompanying notes are an integral part of the financial statements.