Page 210 - BTSGroup ONE REPORT 2021/22_EN

P. 210

208 l Introduction l Nature of Business l Organisation and Shareholding Structure l Business Review l Corporate Governance l Financial Statements l Other Information l

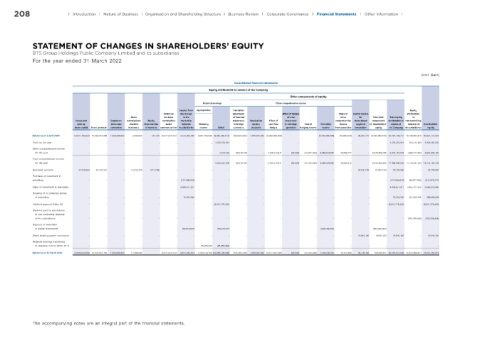

STATEMENT OF CHANGES IN SHAREHOLDERS’ EQUITY

BTS Group Holdings Public Company Limited and its subsidiaries

For the year ended 31 March 2022

(Unit: Baht)

Consolidated f nancial statements

Equity attributable to owners of the Company

Other components of equity

Retained earnings Other comprehensive income

Surplus from Appropriated Translation Equity

Def cit on the change adjustment Effect of hedges Share of Capital reserve attributable

Share business in the of f nancial of a net other for Total other Total equity to

Issued and Surplus on subscriptions Equity combination ownership statements Revaluation Effect of investment comprehensive share-based components attributable to non-controlling

paid-up debenture received from exercise under interests Statutory in foreign surplus cash f ow in a foreign Cost of Fair value income payment of shareholders’ owners of interests of Shareholders’

share capital Share premium conversion in advance of warrants common control in subsidiaries reserve Def cit currencies on assets hedges operation hedging reserve reserve from associates transaction equity the Company the subsidiaries equity

Balance as at 1 April 2020 52,617,184,324 10,324,412,868 1,356,596,955 2,448,622 741,720 (3,371,978,137) 2,572,435,338 3,067,163,844 (9,845,295,672) (194,823,335) 1,816,687,952 (5,042,939,259) - - (3,120,386,299) (19,946,874) 29,407,710 (6,532,000,105) 50,191,709,757 10,736,062,478 60,927,772,235

Profit for the year - - - - - - - - 4,576,272,974 - - - - - - - - - 4,576,272,974 783,134,559 5,359,407,533

Other comprehensive income

for the year - - - - - - - - 7,314,234 69,818,189 - 2,165,313,911 (83,830) (13,782,289) 4,664,524,042 30,069,272 - 6,915,859,295 6,923,173,529 1,993,212,664 8,916,386,193

Total comprehensive income

for the year - - - - - - - - 4,583,587,208 69,818,189 - 2,165,313,911 (83,830) (13,782,289) 4,664,524,042 30,069,272 - 6,915,859,295 11,499,446,503 2,776,347,223 14,275,793,726

Exercised warrants 27,340,260 46,418,315 - 15,045,470 (741,720) - - - - - - - - - - - (9,322,745) (9,322,745) 78,739,580 - 78,739,580

Purchase of investment in

subsidiary - - - - - - (222,098,879) - - - - - - - - - - - (222,098,879) (89,877,398) (311,976,277)

Sales of investment in subsidiary - - - - - - 4,439,977,817 - - - - - - - - - - - 4,439,977,817 2,455,101,678 6,895,079,495

Issuance of in preferred shares

of subsidisry - - - - - - 75,533,520 - - - - - - - - - - - 75,533,520 291,355,426 366,888,946

Dividend payment (Note 48) - - - - - - - - (5,921,276,433) - - - - - - - - - (5,921,276,433) - (5,921,276,433)

Dividend paid by subsidiaries

to non-controlling interests

of the subsidiaries - - - - - - - - - - - - - - - - - - - (293,299,436) (293,299,436)

Disposal of investment

in equity instruments - - - - - - (54,614,822) - 339,214,213 - - - - - (284,599,391) - - (284,599,391) - - -

Share-based payment transaction - - - - - - - - - - - - - - - - 19,643,183 19,643,183 19,643,183 - 19,643,183

Retained earnings transferred

to statutory reserve (Note 38.1) - - - - - - - 36,355,346 (36,355,346) - - - - - - - - - - - -

Balance as at 31 March 2021 52,644,524,584 10,370,831,183 1,356,596,955 17,494,092 - (3,371,978,137) 6,811,232,974 3,103,519,190 (10,880,126,030) (125,005,146) 1,816,687,952 (2,877,625,348) (83,830) (13,782,289) 1,259,538,352 10,122,398 39,728,148 109,580,237 60,161,675,048 15,875,689,971 76,037,365,019

The accompanying notes are an integral part of the financial statements.