Page 213 - BTSGroup ONE REPORT 2021/22_EN

P. 213

BTS Group Holdings Public Company Limited 6.3 Financial Statements 211

Annual Report 2021/22

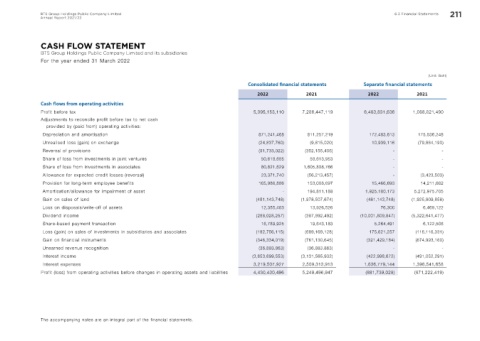

CASH FLOW STATEMENT

BTS Group Holdings Public Company Limited and its subsidiaries

For the year ended 31 March 2022

(Unit: Baht)

Consolidated f nancial statements Separate f nancial statements

2022 2021 2022 2021

Cash f ows from operating activities

Profit before tax 5,095,153,110 7,286,447,119 6,403,831,636 1,068,821,490

Adjustments to reconcile profit before tax to net cash

provided by (paid from) operating activities:

Depreciation and amortisation 871,241,468 811,257,219 172,483,613 175,536,248

Unrealised loss (gain) on exchange (24,837,760) (9,815,020) 10,939,116 (79,864,190)

Reversal of provisions (91,733,022) (352,155,406) - -

Share of loss from investments in joint ventures 50,618,685 58,613,953 - -

Share of loss from investments in associates 80,821,629 1,605,808,766 - -

Allowance for expected credit losses (reversal) 23,371,740 (56,213,457) - (3,423,503)

Provision for long-term employee benefits 165,986,886 153,008,697 15,466,693 14,211,662

Amortisation/allowance for impairment of asset - 194,811,188 1,925,180,173 5,272,975,705

Gain on sales of land (481,143,748) (1,978,507,674) (481,143,748) (1,925,809,858)

Loss on disposals/write-off of assets 12,355,463 13,926,526 76,300 6,469,122

Dividend income (288,028,257) (387,892,492) (10,001,809,847) (5,322,641,477)

Share-based payment transaction 16,789,925 19,643,183 5,264,491 6,122,506

Loss (gain) on sales of investments in subsidiaries and associates (182,756,115) (689,169,128) 175,621,257 (116,116,331)

Gain on financial instruments (346,334,019) (761,130,645) (321,429,184) (874,993,160)

Unearned revenue recognition (36,883,863) (36,883,863) - -

Interest income (3,653,699,553) (3,131,565,932) (422,998,672) (491,052,291)

Interest expenses 3,219,507,927 2,509,313,913 1,636,779,144 1,398,541,658

Profit (loss) from operating activities before changes in operating assets and liabilities 4,430,430,496 5,249,496,947 (881,739,028) (871,222,419)

The accompanying notes are an integral part of the financial statements.