Page 79 - BTSGroup ONE REPORT 2021/22_EN

P. 79

BTS Group Holdings Public Company Limited 4.1 Capital Markets Review and IR Activities 77

Annual Report 2021/22

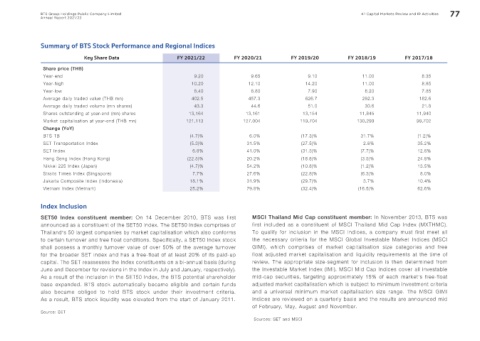

Summary of BTS Stock Performance and Regional Indices

Key Share Data FY 2021/22 FY 2020/21 FY 2019/20 FY 2018/19 FY 2017/18

Share price (THB)

Year-end 9.20 9.65 9.10 11.00 8.35

Year-high 10.20 12.10 14.20 11.00 8.85

Year-low 8.40 8.80 7.90 8.20 7.85

Average daily traded value (THB mn) 402.5 457.3 626.7 292.3 182.6

Average daily traded volume (mn shares) 43.3 44.6 51.0 30.6 21.8

Shares outstanding at year-end (mn) shares 13,164 13,161 13,154 11,845 11,940

Market capitalisation at year-end (THB mn) 121,113 127,004 119,704 130,299 99,702

Change (YoY)

BTS TB (4.7)% 6.0% (17.3)% 31.7% (1.2)%

SET Transportation Index (5.3)% 31.5% (27.5)% 2.8% 35.2%

SET Index 6.8% 41.0% (31.3)% (7.7)% 12.8%

Hang Seng Index (Hong Kong) (22.5)% 20.2% (18.8)% (3.5)% 24.8%

Nikkei 225 Index (Japan) (4.7)% 54.2% (10.8)% (1.2)% 13.5%

Straits Times Index (Singapore) 7.7% 27.6% (22.8)% (6.3)% 8.0%

Jakarta Composite Index (Indonesia) 18.1% 31.9% (29.7)% 3.7% 10.4%

Vietnam Index (Vietnam) 25.2% 79.8% (32.4)% (16.5)% 62.6%

Index Inclusion

SET50 Index constituent member: On 14 December 2010, BTS was first MSCI Thailand Mid Cap constituent member: In November 2013, BTS was

announced as a constituent of the SET50 Index. The SET50 Index comprises of first included as a constituent of MSCI Thailand Mid Cap Index (MXTHMC).

Thailand’s 50 largest companies by market capitalisation which also conforms To qualify for inclusion in the MSCI Indices, a company must first meet all

to certain turnover and free float conditions. Specifically, a SET50 Index stock the necessary criteria for the MSCI Global Investable Market Indices (MSCI

shall possess a monthly turnover value of over 50% of the average turnover GIMI), which comprises of market capitalisation size categories and free

for the broader SET index and has a free-float of at least 20% of its paid-up float adjusted market capitalisation and liquidity requirements at the time of

capital. The SET reassesses the Index constituents on a bi-annual basis (during review. The appropriate size-segment for inclusion is then determined from

June and December for revisions in the Index in July and January, respectively). the Investable Market Index (IMI). MSCI Mid Cap Indices cover all investable

As a result of the inclusion in the SET50 Index, the BTS potential shareholder mid-cap securities, targeting approximately 15% of each market’s free-float

base expanded. BTS stock automatically became eligible and certain funds adjusted market capitalisation which is subject to minimum investment criteria

also became obliged to hold BTS stock under their investment criteria. and a universal minimum market capitalisation size range. The MSCI GIMI

As a result, BTS stock liquidity was elevated from the start of January 2011. Indices are reviewed on a quarterly basis and the results are announced mid

of February, May, August and November.

Source: SET

Sources: SET and MSCI