Page 80 - BTSGroup ONE REPORT 2021/22_EN

P. 80

78 l Introduction l Nature of Business l Organisation and Shareholding Structure l Business Review l Corporate Governance l Financial Statements l Other Information l

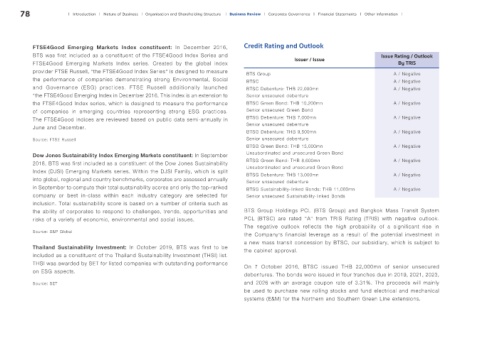

FTSE4Good Emerging Markets Index constituent: In December 2016, Credit Rating and Outlook

BTS was first included as a constituent of the FTSE4Good Index Series and Issue Rating / Outlook

FTSE4Good Emerging Markets Index series. Created by the global index Issuer / Issue By TRIS

provider FTSE Russell, “the FTSE4Good Index Series” is designed to measure BTS Group A / Negative

the performance of companies demonstrating strong Environmental, Social BTSC A / Negative

and Governance (ESG) practices. FTSE Russell additionally launched BTSC Debenture: THB 22,000mn A / Negative

“the FTSE4Good Emerging Index in December 2016. This index is an extension to Senior unsecured debenture

the FTSE4Good Index series, which is designed to measure the performance BTSC Green Bond: THB 10,200mn A / Negative

of companies in emerging countries representing strong ESG practices. Senior unsecured Green Bond

The FTSE4Good indices are reviewed based on public data semi-annually in BTSG Debenture: THB 7,000mn A / Negative

June and December. Senior unsecured debenture

BTSG Debenture: THB 9,500mn A / Negative

Source: FTSE Russell Senior unsecured debenture

BTSG Green Bond: THB 13,000mn A / Negative

Dow Jones Sustainability Index Emerging Markets constituent: In September Unsubordinated and unsecured Green Bond

2018, BTS was first included as a constituent of the Dow Jones Sustainability BTSG Green Bond: THB 8,600mn A / Negative

Unsubordinated and unsecured Green Bond

Index (DJSI) Emerging Markets series. Within the DJSI Family, which is split BTSG Debenture: THB 13,000mn A / Negative

into global, regional and country benchmarks, corporates are assessed annually Senior unsecured debenture

in September to compute their total sustainability scores and only the top-ranked BTSG Sustainability-linked Bonds: THB 11,000mn A / Negative

company or best in-class within each industry category are selected for Senior unsecured Sustainability-linked Bonds

inclusion. Total sustainability score is based on a number of criteria such as

the ability of corporates to respond to challenges, trends, opportunities and BTS Group Holdings PCL (BTS Group) and Bangkok Mass Transit System

risks of a variety of economic, environmental and social issues. PCL (BTSC) are rated “A” from TRIS Rating (TRIS) with negative outlook.

The negative outlook reflects the high probability of a significant rise in

Source: S&P Global the Company’s financial leverage as a result of the potential investment in

a new mass transit concession by BTSC, our subsidiary, which is subject to

Thailand Sustainability Investment: In October 2019, BTS was first to be the cabinet approval.

included as a constituent of the Thailand Sustainability Investment (THSI) list.

THSI was awarded by SET for listed companies with outstanding performance On 7 October 2016, BTSC issued THB 22,000mn of senior unsecured

on ESG aspects. debentures. The bonds were issued in four tranches due in 2019, 2021, 2023,

Source: SET and 2026 with an average coupon rate of 3.31%. The proceeds will mainly

be used to purchase new rolling stocks and fund electrical and mechanical

systems (E&M) for the Northern and Southern Green Line extensions.