Page 157 - BTSGroup ONE REPORT 2021/22_EN

P. 157

BTS Group Holdings Public Company Limited 5.2 Corporate Governance Structure 155

Annual Report 2021/22

Financial Remuneration

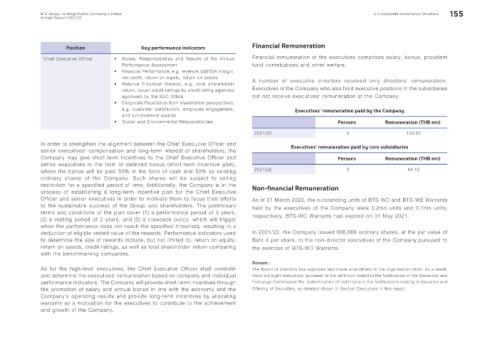

Position Key performance indicators

Chief Executive Officer • Duties, Responsibilities and Results of the Annual Financial remuneration of the executives comprises salary, bonus, provident

Performance Assessment fund contributions and other welfare.

• Financial Performance, e.g. revenue, EBITDA margin,

net profit, return on equity, return on assets A number of executive directors received only directors’ remuneration.

• Relative Financial Metrics, e.g. total shareholder

return, issuer credit ratings by credit rating agencies Executives of the Company who also hold executive positions in the subsidiaries

approved by the SEC Office did not receive executives’ remuneration at the Company.

• Corporate Reputation from stakeholder perspectives,

e.g. customer satisfaction, employee engagement, Executives’ remuneration paid by the Company

and achievement awards

• Social and Environmental Responsibilities Persons Remuneration (THB mn)

2021/22 9 103.62

In order to strengthen the alignment between the Chief Executive Officer and

senior executives’ compensation and long-term interest of shareholders, the Executives’ remuneration paid by core subsidiaries

Company may give short-term incentives to the Chief Executive Officer and Persons Remuneration (THB mn)

senior executives in the form of deferred bonus (short-term incentive plan),

where the bonus will be paid 50% in the form of cash and 50% as existing 2021/22 5 64.13

ordinary shares of the Company. Such shares will be subject to selling

restriction for a specified period of time. Additionally, the Company is in the

process of establishing a long-term incentive plan for the Chief Executive Non-financial Remuneration

Officer and senior executives in order to motivate them to focus their efforts As of 31 March 2022, the outstanding units of BTS-WD and BTS-WE Warrants

to the sustainable success of the Group and shareholders. The preliminary held by the executives of the Company were 0.2mn units and 0.7mn units,

terms and conditions of the plan cover (1) a performance period of 3 years, respectively. BTS-WC Warrants had expired on 31 May 2021.

(2) a vesting period of 2 years, and (3) a clawback policy, which will trigger

when the performance does not reach the specified threshold, resulting in a

deduction of eligible vested value of the rewards. Performance indicators used In 2021/22, the Company issued 666,666 ordinary shares, at the par value of

to determine the size of rewards include, but not limited to, return on equity, Baht 4 per share, to the non-director executives of the Company pursuant to

return on assets, credit ratings, as well as total shareholder return comparing the exercise of BTS-WD Warrants.

with the benchmarking companies.

Remark :

As for the high-level executives, the Chief Executive Officer shall consider The Board of Directors has approved and made amendment to the organisation chart. As a result,

and determine the executives’ remuneration based on company and individual there are eight executives, pursuant to the definition stated in the Notification of the Securities and

performance indicators. The Company will provide short-term incentives through Exchange Commission Re: Determination of Definitions in the Notifications relating to Issuance and

the promotion of salary and annual bonus in line with the economy and the Offering of Securities, as detailed shown in Section Executives in this report.

Company’s operating results and provide long-term incentives by allocating

warrants as a motivation for the executives to contribute to the achievement

and growth of the Company.